After the initial plunge after the referendum, EURUSD has traded sideways in a relatively wide interval between 1.095 and 1.115. - FOMC sidelined for now. Data has picked up, and labour market more solid than May-numbers suggested. Brexit risks loom, although less imminent. However, the July statement gave no indication of a September hike, disappointing markets, which currently price a 50% chance for a second rate hike in September 2017.

Like Fed and ECB stood pat in July. While Draghi denied discussions of potential changes to the policy stance, but referred to the next meeting in September and the new projections published then. We expect further cut in deposit rate and an extension of QE.

Background: - Short-term volatility is likely to benefit the USD - Diverging monetary policy indicate a stronger USD. We see a next Fed hike in December and three hikes in 2017. The ECB is likely to cut the deposit rate to -0.6% and increase its asset purchases. - Despite the anemic recovery in the EMU, the risk of an unfavourable outcome will gradually be reduced. This and EMU current account surplus will supports the euro.

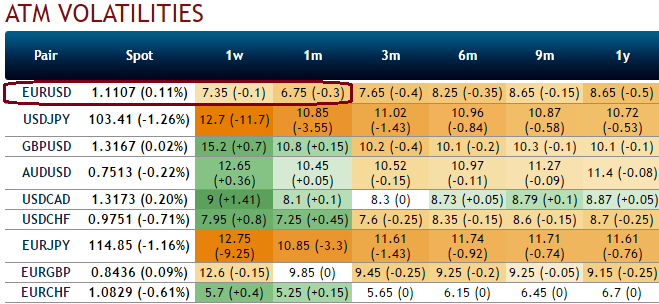

While current IVs of 1W ATM contracts of EURUSD are crawling reluctantly a tad below 7%, a massive drop from recent times, as a result option premiums likely to shrink away on account of time decay.

USD risk-reversals should be pressured further to align with the impulsive retracement in spot.

The strategy goes this way, writing an In-The-Money call and buying deep striking in-the-money call, writing a higher strike OTM calls and buying another deep striking out-of-the-money call for a net debit, all strikes should have similar tenors.

Data radar: Non-farm (Friday) expected to show solid, yet normal employment gains in July. Consensus: 180’. The US Presidential elections looms, with rising political uncertainty - US: ISM mfg (Tue), ISM non-mfg (Thu), core PCE (Tue).

OTC Outlook and Hedging Strategy:

Since the EURUSD's implied volatility is perceived to be comparatively minimal from other major G7 pairs and neutral risk reversal sentiments, accordingly we construct a multiple leg of option strategy for regular traders of this currency cross when there is little IV. A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

Using options expiring on the same expiration month, the option trader creates an iron condor by selling a lower strike OTM put and buying an even lower strike out-of-the-money put, similarly shorting a higher strike OTM call and buying another even higher strike out-of-the-money call. This results in a net credit to put on the trade.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?