The fate of the greenback depends on much more on a far more important issue at present: Janet Yellen’s successor as Fed Chair. The FOMC’s monetary policy decisions are not taken at the Chair’s discretion. But let’s not fool ourselves. Over the past decades, the Chairs considerably influenced US monetary policy. Paul Volcker, who ended high inflation but in return caused the double recession of 1980/82.

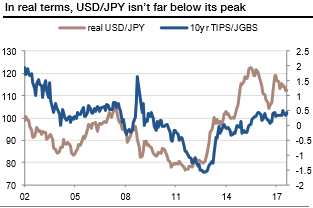

A higher USDJPY relies on US TIPS yields breaking free; we think a test of December’s peak is possible but a break higher is unlikely. It’s also increasingly apparent that yen bears can’t rely on a risk-friendly backdrop alone to help them, given unhelpful cross-currency basis spreads. We’re happy with long USDJPY during the current rising trend in TIPS yields but we’ve lost almost all hope of seeing 120 again and there’s a long-term danger of a move lower, towards PPP-consistent levels closer to 100.

The Bank of Canada has started to normalize monetary policy as an offset to a hot property market, and the CAD has recovered in recent months. But it’s still cheap relative to AUD and NZD and relative to the USD.

Both EUR and JPY are undervalued against the US dollar because getting (and keeping) the currency down has been a policy priority of both ECB and BOJ. Europe’s economy is recovering a little faster than Japan’s and inflation expectations have moved further away from zero, which has allowed the ECB to shift its focus towards slowing bond purchases and normalizing policy far sooner than the BOJ will. We’ve seen EURJPY rally sharply but the current correction offers a chance of a second bite at the cherry. We’re looking for a test of the post-1980- resistance line at 141.

The above chart shows the spread between TPS and JGBs, against an inflation-adjusted USDJPY. Abenomics and BOJ policy took the yen from very overvalued levels to undervalued ones, and has kept it there. It’s not obvious if keeping there would have been possible without a recovery in US Treasury yields in both real and nominal terms, outright and relative to JGBs. As with the ECB, the BOJ will in due course shift focus towards policy normalization but for now, inflation expectations are still much lower (0.3%) than in the US (2.3%) or the Euro area (1.6%).

As a propensity for consolidating within the triangle pattern, USDJPY has most likely peaked in 2015 at the multi-decade trend line resistance (then at 126, now at 123).

The 10y TIPS yield is grinding higher after encountering support near the 5-year trend line support at 0.25%/0.20%.

Our measure of USDCAD PPP is around 1.15, suggesting there’s some more room for CAD to out-perform the US Dollar. More importantly though, now that Alberta’s economy has stabilized, the bank of Canada is focusing on policy normalization and taming a (too) strong property market. Canada escaped the worst of the global financial crisis has no domestic (non-FX) need for emergency levels of rates. Getting CADJPY back to the previous peak levels in real terms would see spot around 100.

A 10% move higher in EURJPY would take it back to 2007 and 2014 levels in real terms. Yield differentials are steadily moving in the euro’s favor and that trend will continue as long as the BOJ keeps JGB yields depressed. EURJPY ‘fair value’ is around 137, so there’s a bit further to go on that basis, but that big differentiator is that the ECB is minded to begin policy normalization much earlier than the BOJ. Courtesy: JPM

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal