The sharp appreciation of CNH was a major development in FX markets this week. Coming on the heels of a change in the PBoC's daily USD/CNY fix mechanism the previous Friday, markets seem to have interpreted these moves as signalling a regime shift in FX policy in favor of RMB appreciation, or at the very least, an end to the controlled depreciation strategy of the past two years. The reaction in options markets was swift and severe, with 1M ATMs spiking more than 2 vols at one stage, and 1M risk-reversals flipping to negative (bid for USD puts over USD calls) for the first time since 2011. A semblance of calm returned to CNH markets towards the end of the week, as the move in spot below 6.74 closed a yawning catch-up gap vis-à-vis the rest of USD/Asia and prompted a wave of profit-taking on long CNH positions.

Our working assumption is that the velocity, if not the extent of additional CNY strength will moderate going forward but not reverse altogether. A more modest pace of spot moves should calm realized vols and have a dampening effect ATMs, while weaker spot vs. vol correlations should prevent risk-reversals from slipping further into negative territory.

Flow pressures are likely to reinforce mean-reversion in the vol surface lower, by supplying downside strikes (OTM USD puts) to the street through a combination of profit taking on outright USD put /CNH call option positions and fresh option purchases to milk residual RMB strength in the form of USD put spreads.

Our preferred option structures from here are ratio USD put/CNH call spreads that

a) Participate in what could turn out to be in an erratic, slow grind stronger in the renminbi,

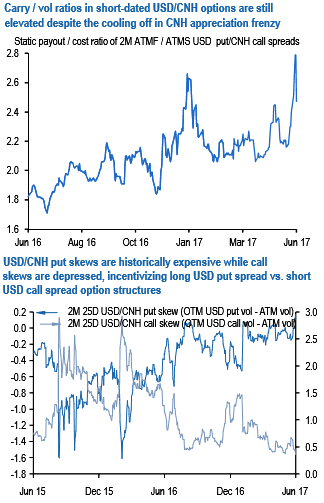

b) Take advantage of the still-elevated carry / vol ratio (refer above chart) even after the blowout in forward points has partially retracted, and

c) Are both net short vol and long risk-reversals in alignment with the likely direction of vol surface re-pricing. For instance, 2M 6.80/6.72 1*2 USD put/CNH call spreads cost ~ 15bp (spot ref. 6.79) for a maximum payout of 120bp, fully recoup the small premium outlay should spot remain unchanged by virtue of the ITMS strike, and have a breakeven spot level of 6.63, which is comfortably below pre-US election levels.

We also like complementing them with near zero-cost long USD put /CNH call spreads financed by selling USD call/CNH put spreads partly to take advantage of the divergent historical rich/ cheap of USD put and USD call skews (refer above chart), and in large part to express a view that the regime change signalled by this week’s moves represents something more substantial than a mere one-and-done affair and can be trusted to comfortably cap spot upside even if additional downside from here is fitful.

For instance, off spot ref. 6.79, 4M 6.80/6.72 USD put spreads vs. 6.95/7.05 call spreads cost ~8bp in premium for the potential max payout of 150bp and subject to the maximum liability of 142bp.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One