Fundamental glance:

Although the Kiwi dollar surged a bit in the recent times but sensing more bearish pressures in the upcoming future especially ahead of the Chinese trade balance data is scheduled to be announced, this data showed that China’s imports dropped far more than expected last month and although short-term dollar stress is seen FX markets, the greenback remained supported by Hawkish US central bank’s tone.

The FOMC remained on hold, as expected, at 0.50%-0.75%. There was little fresh news in the statement - risks are still seen "roughly balanced", activity is expected to expand at a "moderate pace" and that warrants "only gradual increases" in rates. The Fed conceded that the sentiment surveys have formed: "Measures of consumer and business sentiment have improved of late" and their confidence on inflation has firmed a touch, the Fed noting: "inflation will rise to 2 pct" (vs "Inflation is expected to rise to 2 pct" previously). Otherwise, current conditions are largely unchanged, job gains are still considered "solid" and activity is growing at a "moderate pace". There are no strong clues here that the Fed is agitating to hike in March.

OTC outlook and hedging framework:

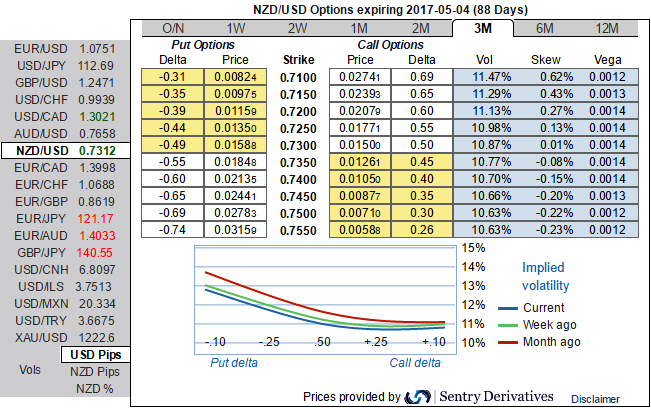

You could notice OTC market discounting the fundamental factors in 3m IV skews (the positively skewed IVs would imply that there are more bids for OTM put strikes).

Well, to mitigate these bearish risks, at spot reference 0.7313 we reckon the NZDUSD options strips with narrowed strikes.

Hence, we advocate to initiate longs in 2 lots of 1y -0.49 delta put options, while buying 1 lot of +0.51 delta calls of similar expiry.

On the flip side, NZD has been gaining its traction in its consolidation phase against USD from the last month. Well, as a result of the speculation in the FX market, although the Kiwi dollar surged a bit in the recent times but OTC indication signals bearish pressures in the weeks to come as the greenback remained supported by Hawkish US central bank’s tone.

Even if the underlying spot goes against our anticipation, the underlying risk is properly mitigated regardless of swings. As you can probably understand from the payoff function, the strategy can also be utilized on speculating grounds as it is likely to fetch certain yields.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action