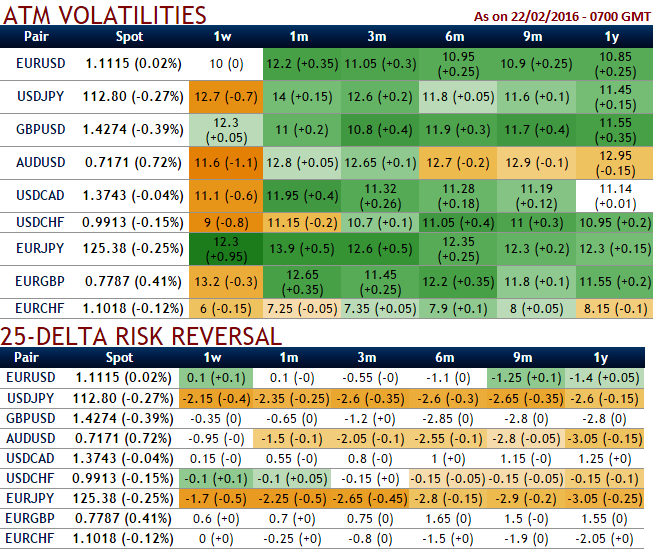

The implied volatility of ATM contracts for 1M-3M expiries of this the pair is flashing at around 12%.

Delta risk reversals creeping up gradually with positive ticks for next 1M expiries to signify the hedging positions are well equipped for upside risks and downside hedging arrangements over the longer period of time. While current IVs of ATM contracts for 1M-3M expiries have been lingering around 11-12% which is at higher levels but likely to perceive hover well above 10% in long run.

Since out of the money levels are liquid moneyness levels in the options market, market quotes these levels as 25 delta call and 25 delta put . If a trader has the right model, he can build the whole volatility smile for any time to expiry by using the three points in the volatility surface.

Technical glimpse:

The pair has just broken an important supports at 1.1063 levels with big real body candle to slip below moving average curves. While leading oscillators converge downward to these price dips.

Hence, comparing this difference between implied volatility, OTC market sentiments, technical reasoning and in options premiums we think the arbitraging opportunity is generated.

Box Spread ratio: (Call - long 1: Short 1; Put - long 1: Short 1)

The long box is used when the spreads are underpriced in relation to their expiration values. A Box options spread consists of buying the call and selling the put at the same lower strike price and buying the put and selling the call at the same higher strike all within the same instrument and expiry month.

How to execute:

Go long in 1M EURUSD (1%) in the money call, Short 1M EURUSD (1%) out of the money call.

Simultaneously, Go long in 3M EURUSD (1%) in the money put, Short 3M EURUSD (1%) out of the money put options.

Essentially, the arbitrager is simply buying and selling equivalent spreads and as long as the price paid for the box is significantly below the combined expiration value of the spreads, a riskless profit can be locked in immediately.

FxWirePro: Diagonal box spreads for EUR/USD risk averse as OTC positioning suggests short euro gains but weakness in long run

Monday, February 22, 2016 1:07 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?