The excessive yen skew premium Yen calls are in high demand for all crosses as the market is behaving in a risk-off way. As we wrote here and here, the yen probably met an inflexion point after months of strength.

A Trump victory would pressure the USDJPY and EURJPY towards the retest of 100 and 112.566 respectively but a break would not at all be to the BoJ’s taste, whereas the Fed is edging closer to a December hike, making a new rebound likely. Well, capitalizing the ongoing rallies to write the overpriced ITM puts would be a smarter approach while formulating hedging strategy through put ratio back spread.

Selling outright yen volatility or skew is not a reasonable trade given the imminent risk event, but selling the yen skew premium as a leg of a relative value trade appeals.

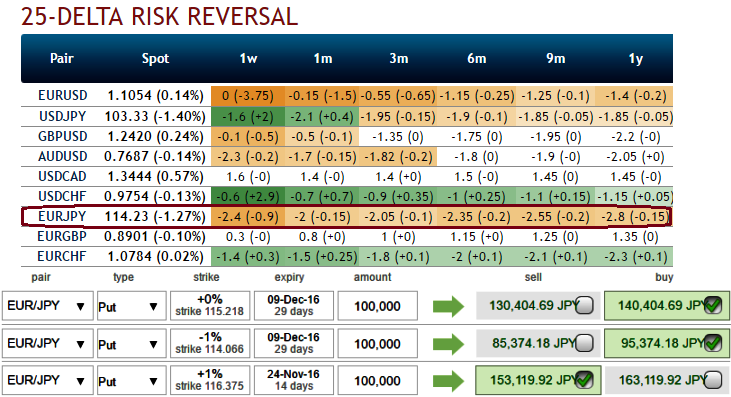

Stay short EURJPY rather than USDJPY skew, the EURJPY 3m skew is larger than the USDJPY skew (-2.1 vs -1.8), so that selling the former provides a higher premium.

Moreover, the EURJPY skew exceeding the USDJPY is not consistent in times of EUR topside volatility. On the contrary, euro bullishness should dampen the EURJPY skew, which is, therefore, an attractive sell.

The spread between EURJPY and EURUSD 3m risk reversals is now very elevated historically, as it is exceeding 1.5 vols (see above graphs).

It never happened between 2012 and 2015 and such a situation happened only very transitorily this year. We expect the gap between EURJPY and EURUSD skews to tighten.

As you can see delta risk reversals are indicative of participants in this pair are more concerned about further slumps especially in next 1month’s timeframe. Rising negative flashes indicate active hedging sentiments for these downside risks.

Acknowledging the gradual decrease in the implied volatility of EURJPY but with the higher negative risk reversals in long run is justifiable when you have to anticipate forwards rates and observe the spot curve of this pair (see IVs, RR nutshell, Sensitivities, and compare with spot prices).

The major declining trend is still under pressure, from the last two years or so the pair has consistently evidenced considerable price slumps from the last couple of months, and we could still foresee more downside potential ahead, hence, the long-term foreign traders are advised to safeguard their portfolios with this downside risks via below option strategy.

Hedging Positioning:

“Short 2w (1%) ITM put option, go long in 1 lot of long in 1m ATM -0.49 delta put options and another 1 lot of (1%) OTM -0.36 delta put of 1m25d tenor.” Using diagonal tenors would keep us hedging positions riskfree as well as reduces the cost of hedging to almost 50%.

The position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement. The position uses long and short puts in a ratio, such as 2:1, to maximize returns.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge