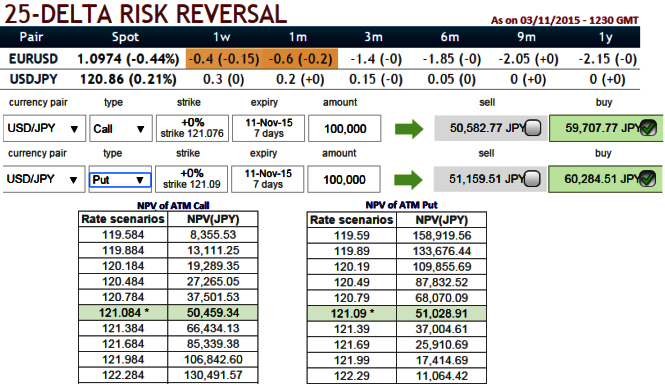

From the nutshell showing delta risk reversal of ATM contracts and Net Present values of ATM instruments, it is understood that the ATM calls have been relatively on higher demand (this is just the resultant sentiments from recent rallies in this pair).

At the money calls seems costlier which divulges the market sentiments for USD/JPY pair (NPV of 1w ATM call is 50459.34 while premiums trading above 18.32% at JPY 59707.77 for lot size 100,000 units). But if you have to observe on an order flow analysis these are nothing but the speculative movements.

It also reveals the hedging activity for downside risks are intensified anticipating from 1 week to next 3 months in it is going in favor of Yen.

As a result we come up with suitable hedging framework for slight downside risks. Place call ratio spread with 1:2 ratios. Current USDJPY FX spot is ticking at 121.047.

How to execute: Buy ITM 0.5 delta call with longer expiry (let's say 1m tenor). Sell two lots of 4D OTM strike calls (124.275). Thereby, we've formulated the strategy so as to suit the delta risk reversal to take the advantage of overpriced calls by shorting.

The delta value becomes more and more insensitive as the USD/JPY falls lower and lower and hence on the lower side, the delta value is zero.

Why call ratio spread: As the pair has made steep slumps and healthy recovery we see a neutral to bearish environment when you are projecting decreasing volatility (see from next 1 month to 3 month it's been gradually reducing).

Risk/Reward Profile: The risk is unlimited. The reward is the difference in the strike prices plus the net credit, multiplied by the number of long contracts.

FxWirePro: Deploy USD/JPY call ratio spreads as delta risk reversal indicates ATM overpriced calls

Wednesday, November 4, 2015 6:55 AM UTC

Editor's Picks

- Market Data

Most Popular