For demonstration we consider the GBPUSD ATM instruments while formulating option strips strategy.

Scenario 1: When spot GBPUSD keeps tumbling:

The puts we deploy would not very far off from the ATM strike and cheap too because IVs are trading at more than 17.25%.

In terms of percentage they will increase very fast. The call will decrease in value – but it will go OTM.

A 100 point movement can bring in good profits. Because when you book profits and sell the call you will still get a good premium. You are already making good profits from the puts.

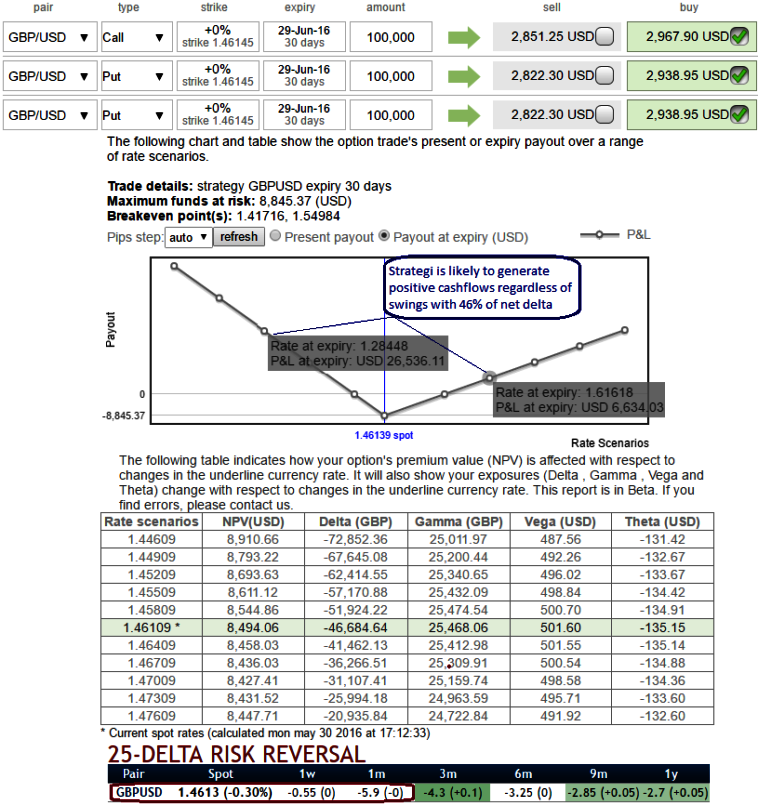

Result: Not a big loss from the call, and great profits from the puts as result of more proportion of puts (1:2) it gives leveraging effects to the portfolio, as you can see from the diagram huge positive cashflows when it dips rather than spikes.

Scenario 2: When spot underlying remains in range:

If the options you bought were cheaper you can hold onto expiration, else you should short after seeing no movement in near future depending upon expiries. Usually whatever movement has to come it comes in near term (3-4 days per sday) after any significant news.

Then the news dies down and normal trading begins. Which indirectly means there is no point in waiting after those 3-4 trading days. Sell all options bought and book loss/profits.

Scenario 3: When spot GBPUSD moves up:

The call option would be already ITM, so it will have a healthy delta and would spike faster. The two put options bought will lose value fast, but this call option will be bringing in profits. Though since its only 1 lot, you may have to wait for some time to book profits.

Not sure here because a lot of Greeks decide the option price but if the underlying moves up 2% up in 2 days – the profit from the call bought should surpass the losses from the puts to a good extend. Remember that volatility has decreased, so 1% movement may not be enough.

Hence, capitalizing on highest IVs of GBPUSD among G10 space, it is wise to bid on 1m risk reversal indications of downside risks of this pair and choose more proportion of put option in your hedging strategy.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate