AUD remained in ranging mode, mostly between 0.7747 and 0.7162:

Remains contained in a consolidative range of 0.7500-0.7600.

AUDUSD in medium term perspective: Lower to 0.7400. The US dollar’s impressive post-election rally may have paused, but still, has potential to rise further during the months ahead. As stated in our previous post on technicals, the major downtrend has been sliding through sloping channel but in the recent past it has gone into consolidation pattern (stuck in a range between 0.7747 levels on north & 0.7162 levels on south) but after testing support 0.7162 levels the prevailing upswings may prolong up to channel resistance (refer monthly plotting).

The Fed’s assertive tightening bias plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar.

Moreover, against that coal and iron ore are likely to sustain a good portion of their dramatic rises, and economic data for Q4 and Q1 should improve, but these forces are subservient to the US dollar’s trend. Australia’s AAA rating will remain an issue into the May budget.

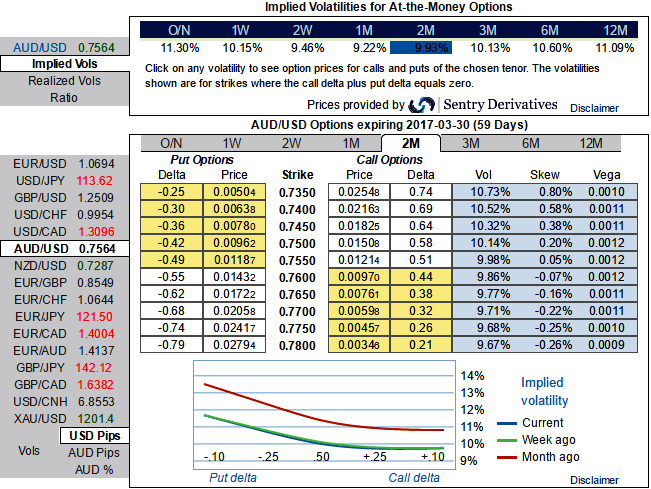

OTC updates & option strategy:

Initiate longs in 2m AUDUSD (0.5%) in the money -0.55 delta put; simultaneously, short 2m (2.5%) out of the money call (strikes at 0.7750) at net debit.

AUDUSD's higher IVs with negative delta risk reversal can be interpreted as an opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Rationale: Let’s glance on sensitivity tool for 2m IV skews would signify the interests of OTM put strikes that would imply that the ATM puts the higher likelihood of expiring in-the-money, so writing overpriced OTM calls would be a smart move to reduce hedging cost.

Fed Chair Yellen delivered hawkish comments on Wednesday, adding that the economy is approaching the Fed's dual mandate of inflation and employment. She further mentioned that the US is near full employment and with inflation figures stabilizing; there is a need for gradual Fed tightening, although she did not mention the exact timing of an interest rate hike.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts