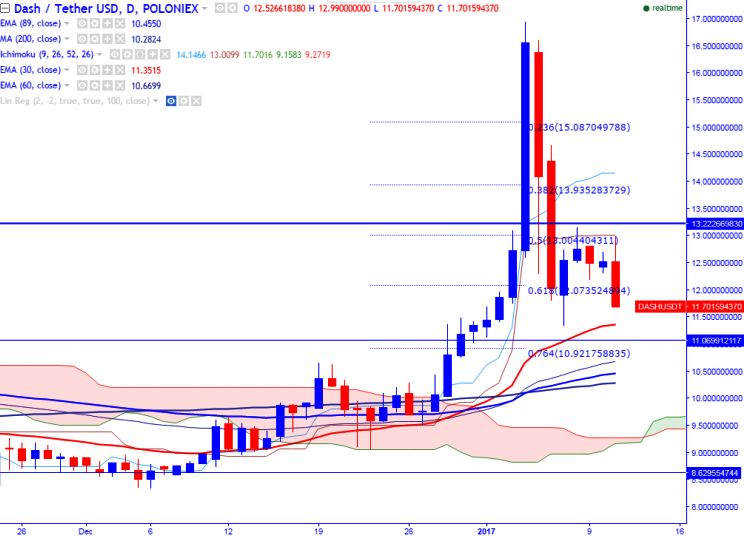

DASH/USDT is seen trading below in red on Wednesday. The pair has once again declined after jumping till USDT12.99 levels (Poloniex). It is currently trading around USDT11.54 at the time of writing.

Ichimoku analysis of daily chart shows:

Tenkan-Sen level: USDT14.14

Kijun-Sen level: USDT13

Trend reversal level - (89 day EMA) – USDT10.42

The long- term trend remains to be bullish. DASH/USDT faces strong support at 61.8% fibo and any break below will take the pair till USDT11.34.

Major resistance –USDT12.99 (daily Kijun-Sen) and any break above targets USDT14.03 (daily Tenken-Sen)/USDT14.79 (61.8% retracement of USDT16.94 and USDT11.34). Short term support is seen at USDT12.06 (61.8% retracement of USDT16.94 and USDT9.06) and any break below will drag the pair down till USDT11.24 (30- day EMA) /USDT10.57 (60- day EMA).

FxWirePro: DASH/ USDT upside capped by Kijun-Sen, good to sell on rallies

Wednesday, January 11, 2017 12:06 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary