WTI crude oil gained sharply on supply concerns. It hit a high of $83.60 yesterday and is currently trading at $83.49.

Hurricane Beryl was classified as a category 4 storm moving towards the Gulf of Mexico supporting oil prices at lower levels.

Gasoline demand is expected to increase due to US Independence Day on Jul 4th, 2024.

Major factors for crude oil price movement-

US dollar index (Bullish)- Negative for Crude.

Major resistance - 106.20/107.

Major support- 105.50/104.

Geopolitical tension- Escalation of tension between Israel and Lebanon ( positive for crude).

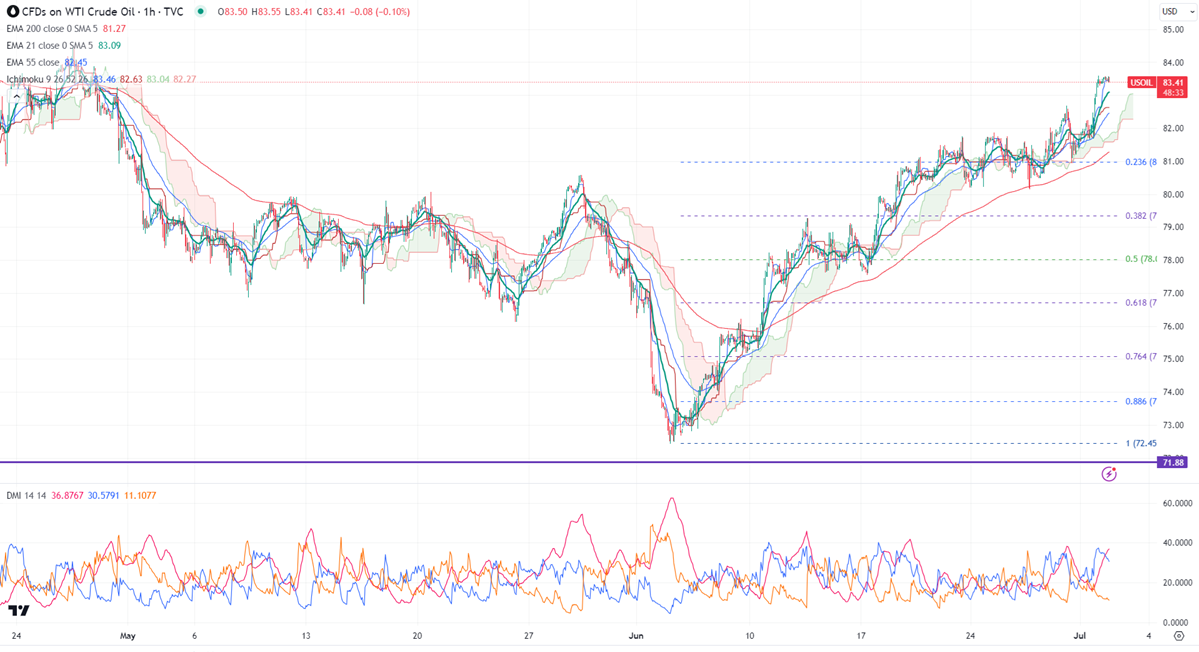

Ichimoku analysis (4- hour chart)

Tenken-Sen- $82.50

Kijun-Sen- $81.88

The immediate resistance is around $83.60. Any jump above the target of $84/$85. On the lower side, near-term support is around $82.60. Any breach below will drag the commodity down to $$81.75/$80.97/80.

It is good to buy on dips around $82.50 with SL around $81.75 for a TP of $85