We turn bearish in RUB on the concern of commodity headwind and seasonally weaker current account outlook over the summer. We are more cautious of the commodity exporter, as terms of trade are unlikely to be favorable for RUB as oil prices remain weak. Together with any potential return of generalized financial market volatility in the coming months, the effect will manifest itself in heightened volatility of RUB.

We recommend buying RUB vol via USDRUB call options. Directionally, we think RUB is vulnerable to weakening over the summer as the current account seasonally deteriorates.

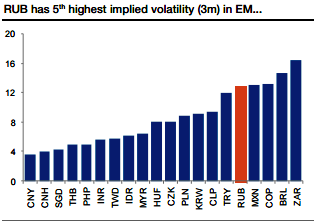

Please be noted that the IVs are the highest among G20 currency space. The volatility parameters favor structures that sell topside skew to cheapen up bullish USDRUB exposure. Being long USDRUB is a good hedge for a portfolio with high yielder exposure.

Buy 3m USDRUB call strike 59, short call strike 62 knock-in 65 Indicative offer: 1.23% (vs 1.06% for the vanilla call spread, spot ref: 56.90)

The position entails buying a USDRUB 3m call strike 59 financed by a call strike 62, with a topside knock-in at 65 only on this short leg. This structure offers potential extra gains compared to the vanilla call spread capped at 62, as the pay-off captures upside up to 65.

In the event of a move beyond this barrier, the maximum gain is the same as for a vanilla call spread.

Our appearing call spread costs only 17bp more than a vanilla proposal, but it potentially hedges twice as much RUB downside (about 10% instead of 5%), providing additional exposure at minimal cost.

Risk profile: Limited to the premium paid Below the 59 call strike, the maximum loss is limited to the premium paid.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts