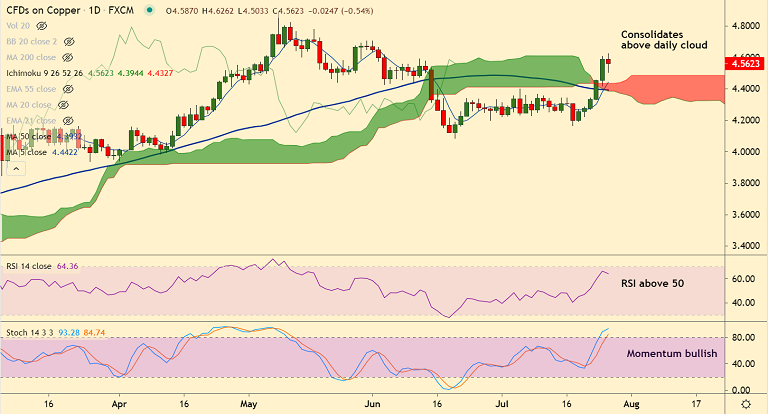

COPPER chart - Trading View

Copper halts a 5-day bullish streak, trades 0.57% lower on the day at 4.56 at around 10:40 GMT.

Commodity markets struggle to cheer China’s deemed restrictions on steel exports to propel industrial profits.

Chinese authorities are inching closer to export limits of the metals after witnessing a fourth consecutive month of declining Industrial Profits.

Fears of economic recovery amid rising cases of the Delta covid variant also keep sentiment depressed.

Focus will be on US Durable Goods Orders and Consumer Confidence data for impetus. Any softer figures may help the Fed to reject tapering concerns, putting a bid under the commodities.

Copper has shown a decisive break above daily cloud, raising scope for further upside.

Price are consolidating cloud breakout, retrace below will negate any further bullishness.