Revising up RBA forecasts and in turn revise and AUDUSD projections on a brighter commodity price outlook and monetary policy stability in 2018.

We still expect AUDUSD to decline modestly over the year ahead. However, stability in local monetary policy, still solid Chinese growth into 2018 and little change in the terms of trade profile in the year ahead mean that the pace of decline is likely to be slow.

The Dec-17 target is lifted by two cents to USD 0.78. In 1H’18 it was reckoned that Aussie dollar should sit around the USD 0.77 level, before declining modestly to USD 0.75 by year-end.

There have been two main developments. The first is the shift in RBA forecast. We no longer expect easing from the RBA in 1H’18, and instead, now forecast a protracted period of policy stability.

For the full rundown, whether the RBA is not in easing phase or not, must it be hiking? This change in forecast implies less contraction in real rate spreads in the year ahead. In addition, the anticipated sharp rise in US core inflation over 2018 (+80bp from 3Q’17 to 3Q’18) also provides some offset to a meaningful decline in real rate spreads.

Chinese data have been volatile in recent months, the Caixin China Services PMI unexpectedly declined to 50.6 in September of 2017 from 52.7 in August, way below market consensus of 53.1. The reading pointed to the weakest pace of expansion in the service sector since December 2015, as both new orders and employment rose at a slower pace and confidence softened. Also, the level of outstanding work at Chinese services companies declined during September, after a four-month sequence of accumulation.

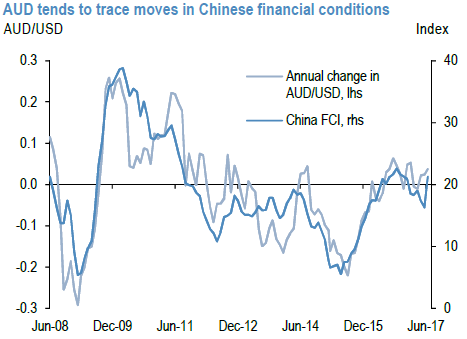

AUDUSD looks broadly fair given the shifts in Chinese financial conditions (refer above chart). These mini-turns in financial conditions have not been easy to predict ahead of time, the cycle length is shortening, and the transmission to commodities looks more speculative than fundamental. Still, these cycles remain influential for AUD.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different