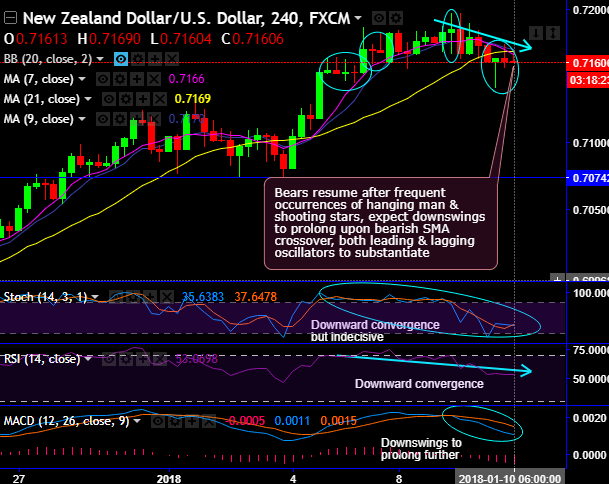

Bears resume in minor trend after frequent occurrences of bearish pattern candles such as hanging man and shooting stars.

Hanging mans have occurred at 0.7169, 0.7166, 0.7163 levels, while shooting stars have occurred at 0.7154, 0.7152, 0.7167 and 0.7161 levels.

7SMA crosses below 21SMA which is a bearish SMA crossover. Expect more downswings to prolong upon bearish SMA crossover, while both leading and lagging oscillators to substantiate this bearish stance.

Both RSI and stochastic curves have been converging to the price dips to indicate strength and momentum in the downtrend.

While MACD’s bearish crossover also substantiates the extension of downswings.

On major trend, bearish engulfing pattern candle has occurred at 0.7176 levels, attempts of bull swings were restrained below the stiff resistances of 0.7499 levels, Shooting star has rightly placed at these resistance levels to indicate weakness, consequently, prices slid below EMAs.

Can bears continue the major downtrend? This would be answered by both leading and lagging indicators (refer 4H charts).

Overall, the frequent occurrences of above-stated bearish pattern candlesticks are coupled with the selling indications by both leading & lagging technical indicators signal weakness in this pair.

Hence, we recommend shorting rallies on hedging grounds and decide to initiate shorts in futures contracts with mid-month tenors.

Well, at spot reference: 0.7165, contemplating lingering bearish indications, on hedging grounds we recommend shorting mid-month month futures as the underlying spot FX likely to target southwards 0.68 levels.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 18 levels (neutral), while hourly USD spot index was at shy above 133 (extremely bullish) while articulating at 07:03 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary