In August, the Bank Rate of BoE was lifted to 0.75%. The market does not expect that the Bank Rate would be hiked until late next year, even though there seems to be high uncertainty about the exact timing of the hike, the right-hand chart below. This corresponds well with our long-held forecast, pointing to a hike in November 2019. We anticipate that the present guidance; i.e. that hikes will continue at a gradual pace and to a limited extent, will be maintained at this meeting. In addition, the BoE may indicate how monetary policy could respond to a no-deal Brexit.

The euro come under some pressure overnight as the slump in the vote for the German coalition parties added to concerns about geopolitical uncertainty. Sterling meanwhile remains close to recent trading lows against both of the US dollar and the euro ahead of this week’s UK budget and policy update from the Bank of England.

OTC Outlook and Options Strategy:

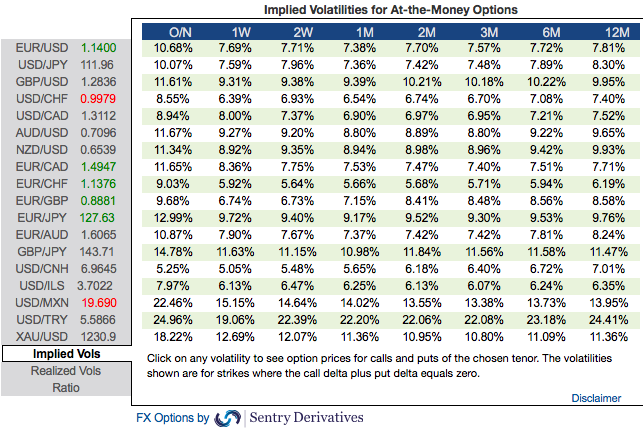

Please be noted that EURGBP implied volatilities of short-term tenors are shrinking away, while long-term tenors are rising. Positively skewed IVs of 2w have been well-balanced on either side, while the same has been indicating bullish risks by bidding OTM call strikes.

Risk reversals of this pair is also signifying the same hedging sentiments (mild bearish swings in the short-run and upside risks in the long-run).

Hence, we devise diagonal credit call spread on hedging grounds that addresses both short-term downswings and long-term upside risks.

This option strategy to keep the potential bullish price risk caused out of fundamental events on check.

Keeping the both fundamental and OTC factors in mind, it is advisable to initiate long in 2M ATM 0.51 delta call, simultaneously, writing 2w (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the underlying spot FX price is anticipated to drop moderately in the near term and spikes up in the long-term.

The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -82 levels (which is bearish), while hourly GBP spot index was at -61 (bearish) while articulating (at 10:54 GMT). For more details on the index, please refer below weblink:

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts