As expected by us, China’s investment growth slowed. Latest data showed that China’s fixed asset investment grew 8.6% YoY year-to-date in May, below market expectations and previous reading at 8.9%. After seasonal adjustment, the fixed asset investment gained 0.72% MoM in May, down from 0.75% in April and 0.79% in March.

Clearly, there emerged a gradual downward path in the underlying momentum, indicating that China’s economy will continue to face headwinds in the coming quarters. There are two factors behind the slowing investment momentum.

First, the policy tightening, including the measures in the property and financial sectors, has dragged down the investment. Indeed, the property prices have peaked in China, and the housing sales have illustrated a sluggish momentum in tandem, which somewhat reminds me of the property-led economic slowdown in 2010-2015.

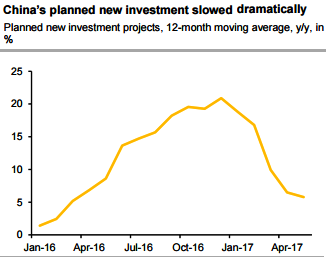

Second, the planned new investment has lost steam entering the year of 2017 (refer above chart), suggesting that the public spending has been gradually fading. Over the full year of 2016, the public stimuli had significantly boosted the investment growth, as suggested by extremely elevated investment from SOEs.

China is a source of angst for global investors with non-financial corporate debt at 166% of GDP compared with 97% a decade ago (refer above chart). The bursting of a debt bubble in China would have far-reaching negative implications for emerging markets either via the risk sentiment channel or through commodity prices, global growth, and the global supply chain.

History tells us that credit booms lead to bubbles and to eventual crises. In China’s case, the risks are compounded by the large size of the banking system relative to GDP (refer above chart). It is unclear if, or when, the bubble will burst in China, but it is the major medium-term risk factor for the entire EM currency complex.

Catalyzed by the PBoC’s announcement of a new CNY fixing formula and the upward squeeze in the CNH interest rates, USDCNY has played catch-up with the broader USD weakness over the past month. As important as these shifts have been in explaining the USDCNY move from 6.90 to 6.80, they remain secondary, in our view, to the fact that China’s underlying BoP position has evolved stronger than market expectations and currency appreciation pressures were already building.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics