Nearly two weeks ago, our Chinese economists revised their growth forecast for 3Q’17 40bps lower to 6.2% QoQ after July activity data surprised significantly to the downside and August only improved modestly.

While metals activities on the ground improved in the H2 of August and September has been strong so far, in our opinion 3Q metals demand was a step down from the very strong 2Q levels.

The write-down by the economists in our opinion further fortifies our view that Chinese metals demand is broadly in the process of rolling over.

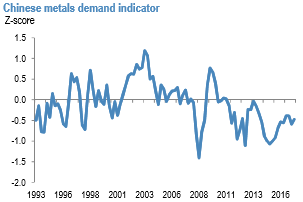

With nearly three-fourths of this year in the books, the metals markets still seem to be wrangling with getting a firm understanding of where Chinese demand is headed. To frame the discussion, our long-term Chinese metal demand indicator based on the average z-scores of year-over-year changes for 18 metals-specific Chinese flow indicators including data covering the real estate, construction, automotive, and white goods sectors has been rather muted over the last year and a half (refer above chart).

More specifically, after bottoming out below -1.0 in early 2015, the demand indicator has recovered somewhat, ranging largely around -0.5 since 2Q’16, but still remains negative and more importantly lacking any clear directional signal, in our opinion.

So while it was clear to us that the Chinese economy and base metals demand in the country remained slightly stronger than we were expecting in the H1’2017, now, less than a week away from the Golden Week holiday kicking off the Q4, everything related to Chinese base metals demand feels a lot more in flux.

Base metals prices on the London Metal Exchange diverged amid thin trading volumes during the Asian morning trading session on Tuesday, October 3, with copper weighed down by profit-taking and a stronger dollar.

With Chinese markets, including the Shanghai Futures Exchange, closed for the country’s National Day Golden Week holiday (October 2-6), trading has been quiet.

To summarize, China’s economic moderation appears to already be underway and September PMI’s this weekend will give us a good temperature reading. Looking forward, in our opinion, the housing/construction, infrastructure, and white goods sectors look most vulnerable in the coming quarter. Auto production and grid investment appear to be holding up for now, but potentially at the cost of 2018. In terms of autos, boosted demand this year will likely cannibalize 2018 with the base case outlook for PV sales growth dropping to just 1% in 2018.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms