British consumers powered the economy through June’s Brexit vote and beyond, but many economists ponder accelerating inflation would weigh on household spending this year. Consumer-price data, as well as measures of producer-price inflation and house prices, would shed some light as to how the slide in the pound since Brexit is feeding into the prices faced by businesses and consumers.

Sterling’s weakness since Brexit vote is pushing up prices of fuel, food, and clothes, official figures to show, as a result, inflation in the UK is set to hit its highest level in more than two years this week.

British consumer prices rose 1.2 pct in a year to November 2016, compared with a 0.9 pct growth in October and above market expectations of 1.1 pct gain, and economists expect it to have picked up to 1.4% in December, with more gains seen in the coming months.

Before we begin with hedging framework, we would like you to know GBPJPY’s intermediate bull trend has exhausted and major downtrend resumed, which was advised in our recent technical posts. Please go through below weblink for more readings:

OTC updates and hedging strategy:

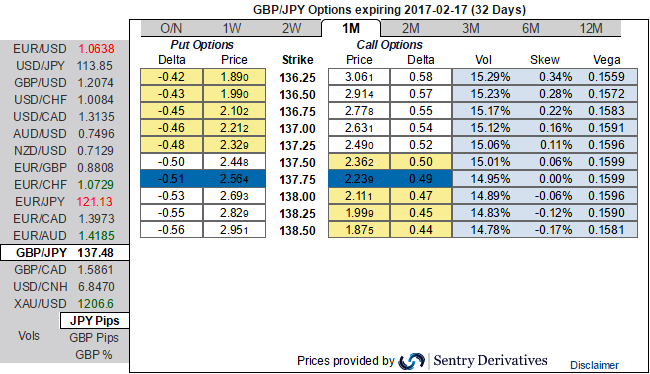

Well, in the recent times, GBP vols skews normalized too much after the Brexit votes, the GBP volatility market normalized sharply (you could observed that in GBPJPY IV skews) which is quite favorable for OTM call option writers but 1m IV skews still signal downside risks owing to harder Brexit. The liquidity recovered and the extreme positioning was ultimately absorbed. The price action is not taking the direction of an imminent new trend. As a result, the option market aggressively unwound smile positions.

The trend monitoring: the major downtrend and short-term upswings into consideration, anyone who wishes to carry long GBPJPY exposures, a collar options trading strategy is recommended. This could be constructed by holding a total number of units of the underlying spot FX while simultaneously buying a protective put and shorting call option against that holding. The puts and the calls are both OTM options having the same expiration month and must be equal in a number of contracts.

The collar is a good strategy to use if the options trader is writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security.

Technically, the collar strategy is the equivalent of an OTM covered call strategy with the purchase of an additional protective put. Capitalizing on 1w IVs and 1m IV skews, we prefer OTM shorts that likely to reduce almost 50% cost of what you pay in the form of the premium on OTM longs.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential