EUR has begun to stabilize following the succession of economic and political shocks that triggered the abrupt depreciation from late April. Importantly, the region’s economy is regaining its composure following the stumble in 1Q and political risk has receded if not been fully eliminated as Chancellor Merkel has survived the immediate crisis over migration policy even as the Italian government weighs its fiscal strategy.

Bearish EURGBP scenarios:

1) ECB delays hiking until 2020as growth and core inflation struggle.

2) Faster US corporate repatriation.

3) Excessive fiscal loosening in Italy (2-ppt+)

Bullish EURGBP scenarios:

1) Growth rebounds to 2.5-3% by mid-2018;

2) ECB becomes more comfortable with progress on wages and core inflation and softens calendar-based rate guidance

OTC indications and Hedging Strategy of EURGBP:

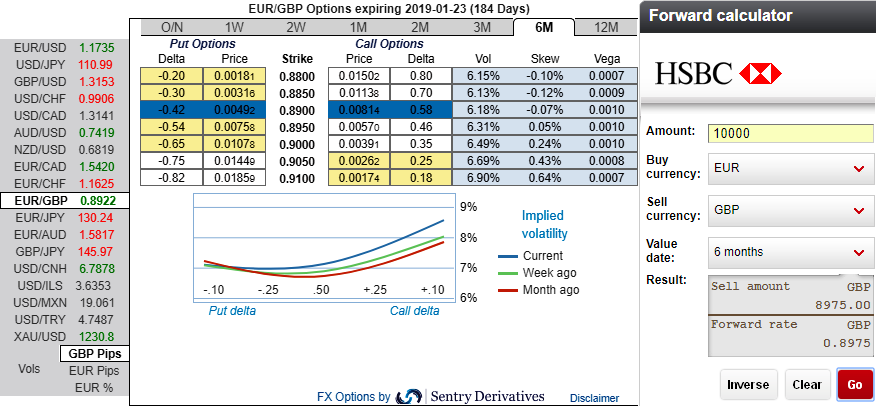

Based on the above driving forces, hedgers seem to be factored-in OTC markets. At spot reference levels: 0.8920, please be noted that the positively skewed IVs of 6m tenors signify the hedgers’ interests to bid OTM call strikes upto 91 levels (refer above nutshell evidencing IV skews). As you could observe EURGBP forward rates, these derivatives instruments also indicate bullish targets of this pair.

Risk reversal of EURGBP is also signalling bullish risks in longer-term tenors, whereas, bearish risks in short-run (refer 1m/6m bids in above nutshell showing risk reversals).

Please also be noted that the implied volatilities of these combinations of tenors (1m and 6m), shrinking IVs in 1m tenor that are supportive for call option writers and rising IVs in 6m tenors that are conducive for options holders.

Hence, we advocate diagonal credit call spread on hedging grounds that addresses both short-term downswings and long-term upside risks.

This option strategy to keep the potential bullish price risk caused out of fundamental events on the check.

Keeping the both fundamental and OTC factors in mind, it is advisable to initiate long in 3M ATM 0.51 delta call, simultaneously, writing 1m (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the underlying spot FX price is anticipated to drop moderately in the near term and spikes up in long term.

The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is at shy above 55 levels (which is bullish), while hourly GBP spot index is edging higher at 21 levels (mildly bullish) while articulating (at 08:11 GMT). For more details on the index, please refer below weblink:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary