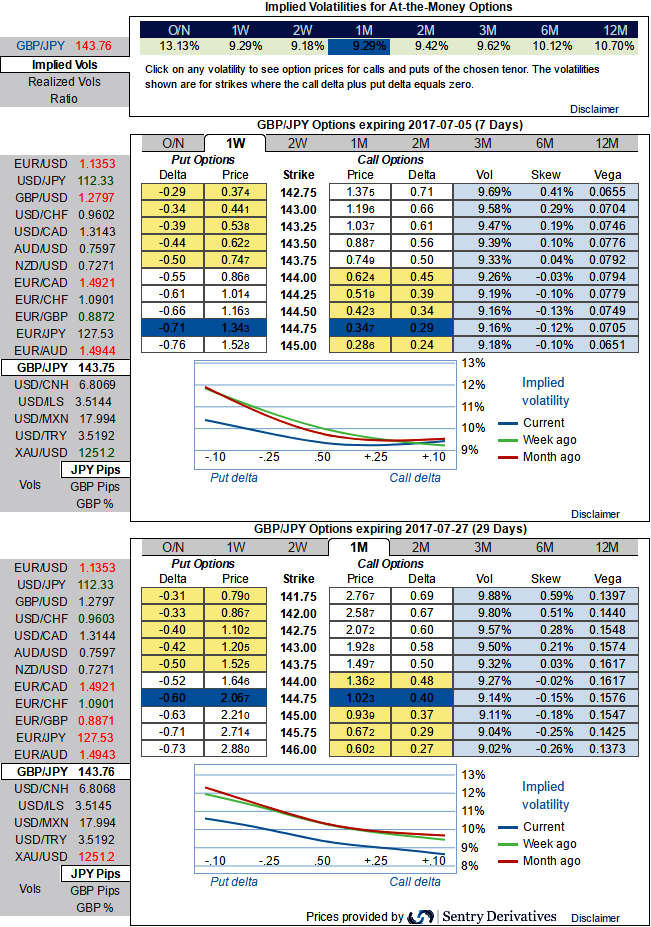

Please be noted that the nutshell showing the positively skewed IVs of GBP against JPY options has been indicating upside risks in short run and downside risks in the weeks to come.

Also, be noted that the ATM call options of 1w expiries have been overpriced 27.5% more than NPV.

Whereas IVs of these tenors are just shy above 9.25%, while higher IVs with positively skewed IVs signify the hedgers’ interest for OTM put strikes.

Mounting negative delta risk reversal can be interpreted as the opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Hence, we advocate weighing up above aspects in below option strategy, we eye on loading up with fresh vega longs for long-term hedging, more number of longs comprising of ATM instruments and OTM call shorts in short term would optimize the strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility.

Further GBPJPY weakness and/or abrupt upswings suggest building a directional and volatility patterns at the same time: the value of OTM puts would likely to rise significantly as the IVs seem to be favoring these distant strikes. We, therefore, recommend shorting 2w IVs and buying IV skews of 2m tenors.

As a result, we believe in jacking up in long leg of the below option strategy:

Initiate longs of 2 lots of 1m at the money gamma put options, simultaneously, short 1 lot of (1%) out of the money call of 1w expiry with positive theta. It is advisable to prefer European style options.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?