Key Economic Fundamentals:

We brief as to how the Brexit would impact the Canadian economy – Canada has relatively limited direct trade linkages with the U.K., the exposure for small and medium-sized businesses (SMEs) – which tend to be predominantly domestically-oriented – is even smaller. In fact, just over 1 in 10 SMEs export, so the direct impacts are fairly limited.

We expect most of the Brexit impact to come through indirect channels, i.e. through the United States. At the same time, the uncertainty that is likely to prevail in markets will take a toll on business and consumer confidence, at least in the near-term.

Perceptions around looming changes related to the Canada Pension Plan, which have flown under the radar, may also contribute to a souring mood among small business owners.

The annual growth forecasts were only downgraded by 0.1 percentage points for Canada in 2016 and 2017 to 1.2% and 1.9%, respectively. This embeds a 0.4 percentage point (annualized) hit in the second half of this year. The global adjustment to a weaker UK and more fragile European Union is expected to culminate in world growth of 2.9% in 2016 and 3.2% in 2017 (down from 3.4% previously)

Brexit only serves to reinforce our resolve that the Bank of Canada will leave its overnight rate unchanged at 0.50% until at least 2018, as a result, other CAD crosses may get disturbed (such as CADJPY, CADCHF or AUDCAD)

FX trading strategy:

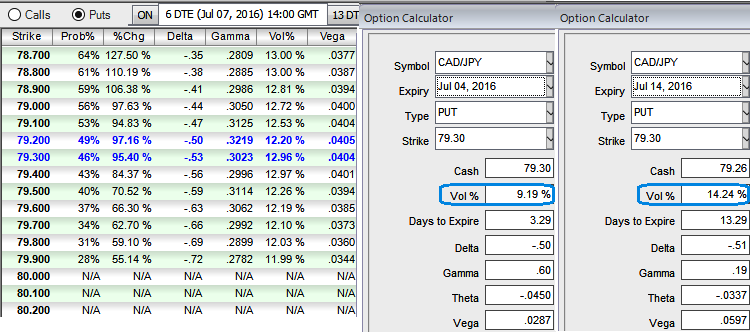

The implied volatility of 1W CADJPY ATM contracts is just 9.19% but likely to spike at 14.24% during 2w expiry.

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Since ATM IVs are likely to spike off 14.24%, and lower vols in short term shorting expensive OTM or ATM calls during bearish circumstance with narrowed tenors would likely result in positive cash flow on expiration. As a result, we capitalize on such beneficial instruments and deploy in our strategy.

How to execute:

Go long in CADJPY 2w at the money delta put, Go long 2w at the money delta call and simultaneously, Short 1w (1%) out of the money call with positive theta.

If one is bearish to very bearish, then one can even eye on writing ATM or ITM calls as well as an alternative to shorting the underlying spot FX.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand