Since August 2017, the major downtrend of this pair has been sliding through sloping channel so far, bulls resumed in this February to counter to evidence the consolidation phase. As a result, bulls have been attempting to break-out this channel resistance (refer monthly chart). That’s where a strong supply zone is observed between 1.53-54 levels.

Both leading and lagging indicators have been in bulls’ favor in this time frame.

But for now, slight overbought pressure has been observed in short run.

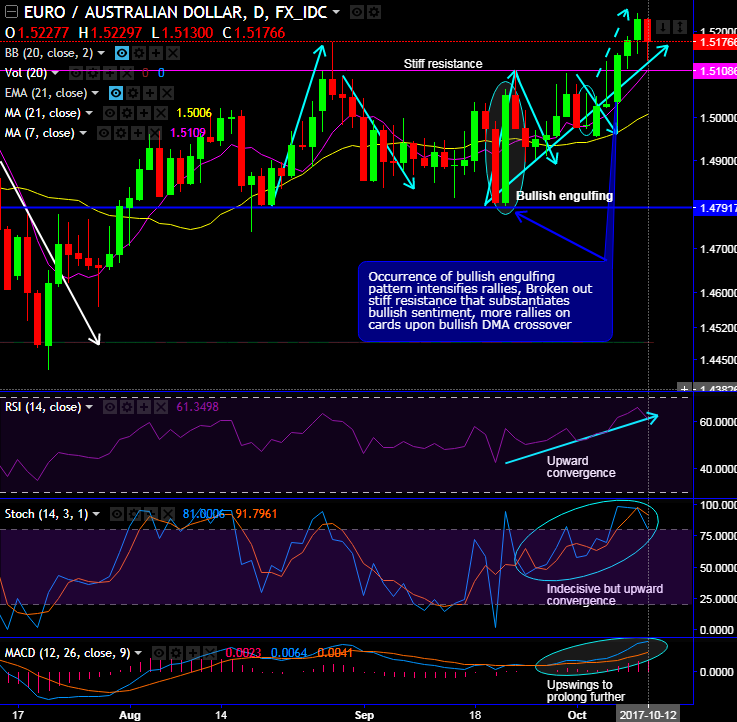

Well, on daily terms, the bullish engulfing pattern has occurred at 1.5050 levels that intensify rallies.

As a result, from the last three weeks, the vigorous bullish streaks are observed ever since the occurrence of the bullish engulfing pattern.

Amid this upward journey, bulls have broken out the stiff resistance of 1.5108 levels that substantiates bullish sentiment.

These buying sentiments are also coupled with both leading oscillators, RSI evidences upward convergence along with the rising prices, while stochastic curves have also been showing upward convergence, even though overbought pressures are observed for the day.

Most importantly, 7DMA has convincingly crossed over 21DMA which is a bullish crossover.

For now, more rallies seem to be on cards upon bullish DMA crossover.

Trading tips:

Contemplating above technical rationale, we advocate boundary binaries on speculative basis using upper strikes at 1.5230 and lower strikes at 1.5108.

The trading between these strikes likely to derive certain yields in this puzzling trend and more importantly these yields are exponential from spot movements.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 1.5230 > Fwd price > 1.5108).

Alternatively, on a hedging grounds, encourage buying futures contracts of far-month tenors in order to mitigate the upside risks.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 123 levels (highly bullish), while hourly AUD spot index was at shy above 51 (bullish) at the time of articulating. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: