Short EURCHF: This trade serves as a portfolio-level hedge against forthcoming European political risk (we have a range of long Europe/short USD bloc trades and so have an implicit long exposure to EURUSD).

But the trade was originally motivated as an outright positive play on CHF, the simple argument being that Switzerland’s underlying balance of payments (BoP) surplus would outstrip the SNB's ability and willingness to grow its balance sheet in pursuit of a stable nominal exchange rate.

We do not expect the SNB to permanently withdraw from the FX market; we nevertheless do expect it to move away from a policy of systematic intervention that could be cited as evidence of de facto currency manipulation and to confine intervention instead to periods of more pronounced FX stress.

The result should be a glacial trend decline in EURCHF, in our view towards the 1.03 level, i.e. a cent a quarter. Low return but also low risk, in our opinion.

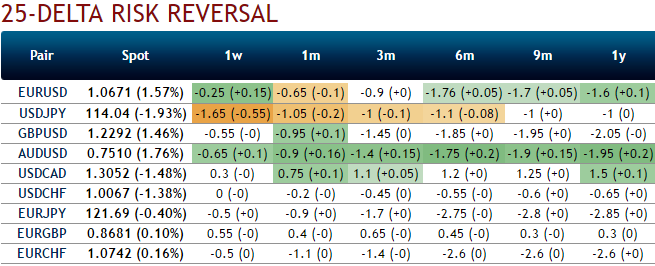

Please be noted that the delta risk reversals of this pair are signaling hedging interests for downside risks, while 1m IV skews also moving in sync with the same indications (please note positively skewed IVs would mean that the hedgers’ interests in OTM put strikes are mounting.

Hence, we advocate staying short in EURCHF via vanilla structures, bidding 3m risk reversal are likely to encompass all potential risks as explained above in conjunction with political risks that is clouded around euro, buy 3m at the money -0.49 delta put options.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts