The macroeconomic data may have improved and headline inflation is on the rise, but these necessary but not sufficient conditions for a more hawkish bias shift at the Bank of Canada will instead probably encounter a patient stance. The rate statement hits the tapes at 10amET on Wednesday along with the Monetary Policy Report and its full set of forecast updates.

Governor Poloz and Senior Deputy Governor Wilkins hold a joint press conference 75 minutes later. Because Fed Chair Yellen speaks twice after the BoC announcements this week, it’s possible that a hawkish sounding Fed will do any of the Bank of Canada’s residual policy work for it on the C$ should the BoC feel the need to retain a cautious but more balanced stance than previously.

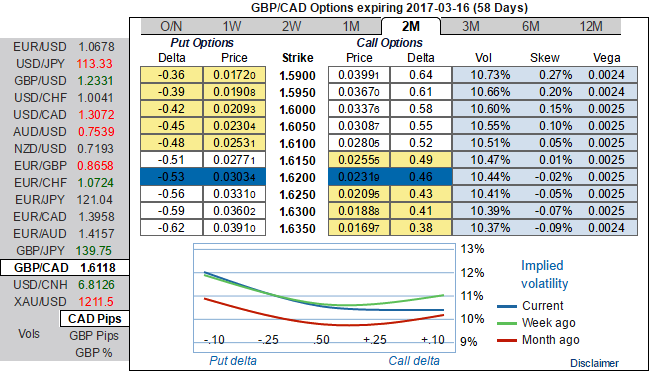

OTC updates and hedging framework:

The main reason behind this decision is that the BoE would not want to add any extra strain on the markets and the British economy in conjunction with the Brexit apprehensions by allowing any speculation about an adjustment of its monetary policy.

In OTC markets, ATM IVs seem to be quite on the edge to factor in the weakness in this pair as we could see reasonable increase in IVs of 2W and 1M tenors. As a result, we recommend capitalizing on the sustainable IV factor by employing ITM short puts as there central bank's decision was also in line with market's expectations and matching this with ATM longs to construct short term back spreads that is likely to fetch positive cash flows as per the indications by sensitivity table.

When trying to assess how a spread may perform, looking at the 2m IV skews spreads of deeper in the money option shorts for an indication of relative option prices.

So, keeping all these attributes in mind, here goes the strategy, go long in 1M 2 lots of ATM -0.50 delta put, and in 2M (1%) OTM -0.36 delta puts, while shorting 1 lot of ITM put (0.5%) put with 2-week expiries.

Subsequently, the slight upward or sideway swings would derive the positive cashflows through the initial receipts of shorts which could be utilized for reducing hedging cost.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?