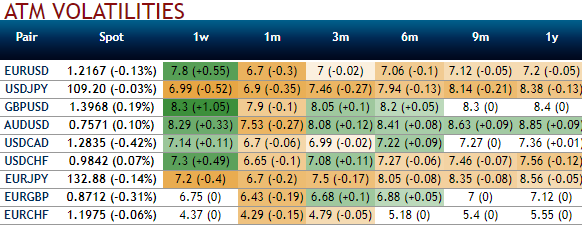

Before we proceed further, let's just quickly glance at IV nutshell and please be noted that the 1m EURGBP IVs are shrinking below 6.43% which is the least among G7 FX bloc with bullish neutral risk reversals. The positively skewed IVs are well balanced on either side that signifies hedgers’ interests of bidding on both OTM calls and OTM puts.

The volatility is the heart and soul of options trading. With the proper understanding of volatility and how it affects your options, you can profit in any market condition. The markets and individual asset class are always adjusting from periods of low volatility to high volatility, so we need to understand how to time our options strategies.

Since EURGBP has been showing the least IVs among G10 FX universe (i.e. 6.43%). Thus, selling volatility outright given the unquantifiable risk. However, shorting volatility and fading the spike in skew through limited loss structures could be an appropriate thing to do under such circumstance.

Hence, bidding call ratio spreads to serve reduced cost of hedging. If at all the pair may bounce back, long legs are likely to keep upside risks on the check. Subsequently, we advocate buying May’18 USDKRW 1:2 call ratio spreads in this write up, using strikes at 0.8620/0.8975, indicative offer: 0.28% (spot ref: 0.8750).

This option setup is a limited return and the unlimited risk bearing strategy that is executed when the options trader reckons that the underlying spot FX would experience little volatility in the near term.

Remember when we talk about volatility we are referring to implied volatility. Implied volatility is forward-looking and shows the “implied” movement in an underlying asset’s future volatility.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown -47 (which is bearish), hourly GBP spot index was at -171 (bearish), while articulating at 10:04 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis