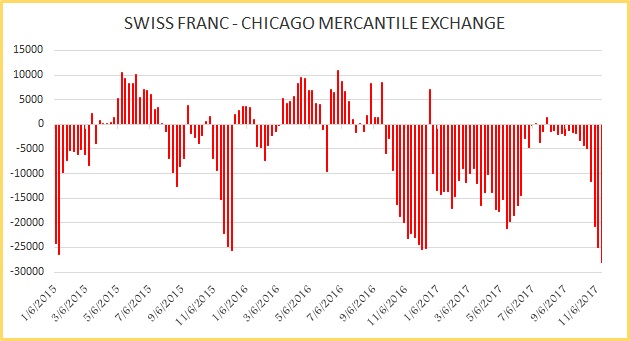

Despite the short interest in the Swiss franc spiking, the bulls are not ready to give in yet. Instead, our calculations at FxWirePro shows that bulls are looking to push the USD/CHF pair to 0.95 support area. Chart 1 shows speculative position in the franc based Commitment of Traders (COT) report.

In an article published in early October, named, “FxWirePro: Franc likely to weaken past parity against dollar”, available at http://www.econotimes.com/FxWirePro-Franc-likely-to-weaken-past-parity-against-dollar-928875 , we forecasted a bearish franc against the dollar. We noted, “One must also take note of the EUR/CHF pair which has finally started the breaking the ceiling with franc depreciating materially against the euro, reaching the weakest level since the SNB removed its 1.2 floor in January 2015. We expect the euro to depreciate in the short term and that is likely to add pressure on the franc which enjoys a very high correlation with the single currency.

We expect the USD/CHF, which is currently trading at 0.971 to depreciate and first test parity and then weaken beyond it towards 1.02.”

While the pair has reached our interim target at parity, it is yet to reach the 1.02 target area. The pair has declined to 0.98 area as of today, riding on a weaker dollar. The target is not likely to get reached unless the bulls are ready to throw in the towel.

We urge our readers for a cautious vigilance of the USD/CHF pair. The pair has been trading in a range of 0.95-1.02 since July 2015.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022