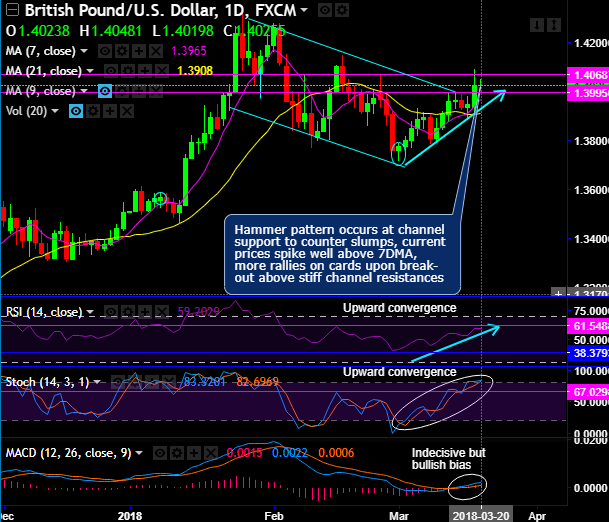

The minor trend of cable (GBPUSD) has broken out sloping channel resistance.

Upswings are again restrained below one more stiff resistance at 1.4068 levels yesterday.

While Hammer pattern occurs at channel support to counter slumps earlier this month, consequently the current prices spike well above 7DMA.

For now, more rallies on cards upon break-out above stiff channel resistances but stiff resistance are observed at 1.4068 levels.

On a broader perspective, the bulls in consolidation phase spike well above EMAs (refer monthly plotting), while both leading oscillators in tandem with these upswings, more rallies likely on bullish EMA & MACD crossovers.

Both RSI and stochastic curves converge upwards to the ongoing upswings on both timeframes.

Trade tips: On an intraday speculative basis, contemplating sideway trend for the day, we advocate boundary binary options to leverage yields. At spot reference: 1.4032, use upper strikes at 1.4068 and lower strikes at 1.3995 levels. The payoff structure would be certain and exponential as long as the underlying spot FX remains between these strikes on binary expiration.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 96 levels (which is bullish). While hourly USD spot index was at shy above 24 (mildly bullish) while articulating (at 06:16 GMT).

For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings