The sharp appreciation of CNH was a major development in FX markets this week. Our working assumption is that the velocity, if not the extent of additional CNY strength will moderate going forward but not reverse altogether.

Beyond the issue of a directional regime shift, there is also a legitimate debate on the implications of the new fixing mechanism for the equilibrium value of CNY volatility. The bull case is that a previously transparent basket-based formula for the fix has turned more opaque due to the introduction of a discretionary counter-cyclical factor, and the risk premium for this incremental unpredictability ought to be reflected in option prices.

The second issue is that the new strong FX policy if that is indeed what this is, seems to be inconsistent with the broader macro-narrative of deleveraging and structural growth slowdown with attendant outward pressure on capital flows, and hence potentially subject to durability risk if financial stability regulation over-tightens domestic financial conditions. The bear argument is that absent broad USD strength that militates against Chinese policy preferences, a strong CNY bias should be inherently vol reducing in line with longstanding spot-vol directionality.

Also, PBoC fixing mini-regimes dating back to the pre-basket days have typically tended to last between 3-6 months, so it is too early and expensive to mull any change/reversal/U-turn, especially given the widely broadcast goal of Chinese authorities to maintain macro stability in the lead-up to the November plenum. Even in the event of an unanticipated global risk shock over the next few months, the counter-cyclical adjustment lever can allow the PBoC to reprise its crisis playbook of flat-lining the fix and sap any realized volatility at the front-end of the vol curve. It is also worth recalling that the pre-basket fix era was associated with consistently sub-2% 1M ATM vol, so current levels of 3.6 appear on the rich side even if full convergence to the old regime does not occur.

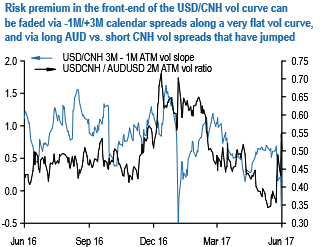

We are more sympathetic to the second camp of a contained front-end vol argument over coming weeks, and like expressing it in pure volatility format by (i) selling 6-wk vs. buying 3M vega-neutral straddle calendar spreads that provide short gamma exposure and take advantage of vol curve flatness (vol indic. 0.1/0.15), and (ii) AUDUSD vs. USDCNH 2M vol spreads in weighted vega notionals to fade the spike in their implied vol ratio (refer above chart) while partially hedging against the economic fallout of ongoing credit tightening.

That the latter is impacting Chinese activity was visible in the disappointing May manufacturing PMI print, and the AUD’s sensitivity to both China growth risks and a less cheerful domestic backdrop makes it one of the best short risk/long vol candidates in our book.

Frontend AUD vol is also an excellent outright buy in its own right given bargain basement implied vol levels (even by the standards of a generally depressed asset class) and nearly non-existent implied/realized premia.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes