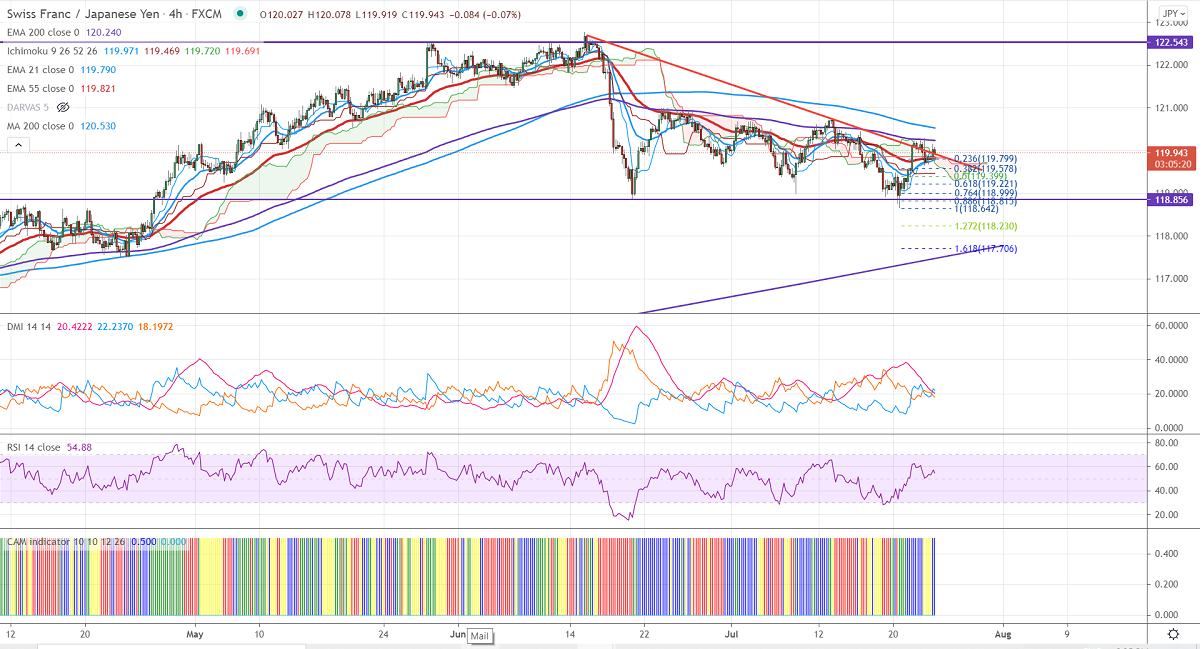

Ichimoku Analysis (4 Hour chart)

Tenken-Sen- 119.97

Kijun-Sen- 119.46

CHFJPY has halted its 5 days of bearishness and shown a jump of more than 100 pips. The recovery was mainly due to a slight weakness in the yen. USDJPY showed a nice recovery and holding well above 200-4H MA.CHFJPY hits a high of 120.15 and is currently trading around 119.95.

USDCHF is consolidating n a narrow range between 0.97250 and 0.91330. Significant bullishness only if it breaks 0.92380.

Technically, near-term support is around 119.60 and any indicative break below will drag the pair down till 119/118.65.

The immediate resistance is at 120.72 (Jul 13th, 2021 high), any convincing break targets 121/122.

It is good to buy on dips around 119.40-45 with SL around 118.65 for the TP of 121.

Resistance

R1- 120.24

R2- 120.52

R3-120.72

Support

S1-119.65

S2-119

S3-118.65