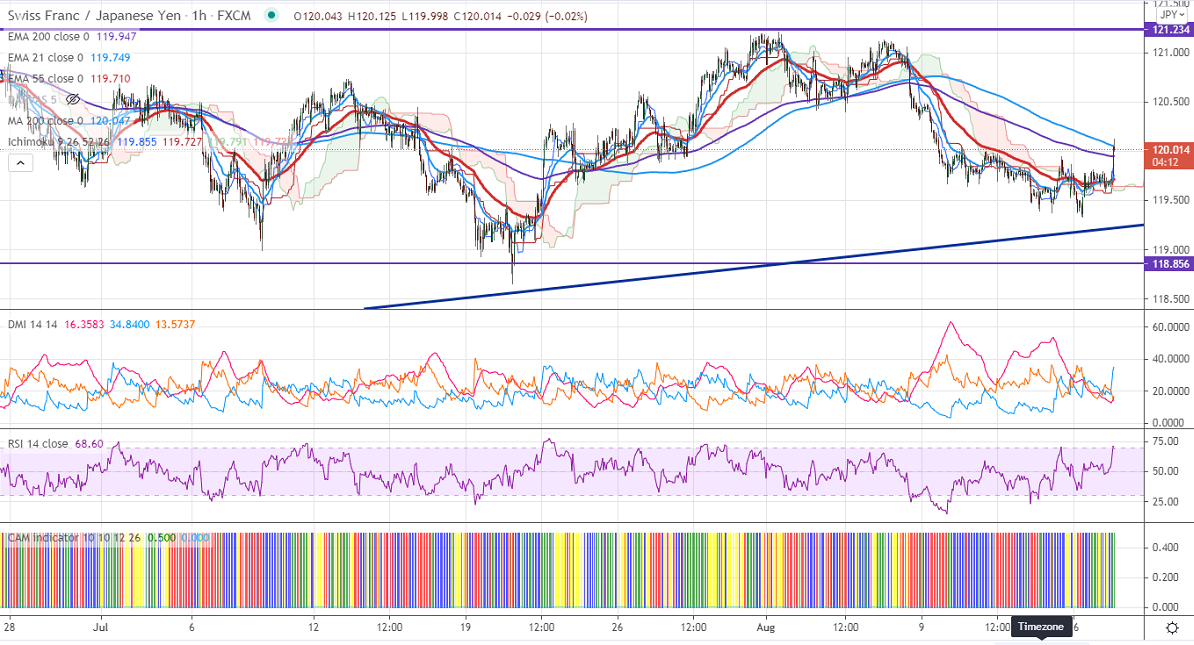

Ichimoku Analysis (1 Hour chart)

Tenken-Sen- 119.82

Kijun-Sen- 119.69

CHFJPY has shown massive recovery today and jumped more than 40 pips on board-based Swiss franc selling. USDCHF continues to trade weak for the third consecutive day and lost more than 100 pips. The minor pullback in the Japanese yen is preventing further buying.

Technically, near-term support is around 119.80 and any indicative break below will drag the pair down till 119.50/119/118.65.

The immediate resistance is at 120.20, any convincing break targets 120.60/121.20/122/123.

It is good to buy on dips around 119.80 with SL around 119.30 for the TP of 121.