The Christmas came early yesterday as CBT refrained from raising interest rates, contrary to consensus expectations. CBT explained its inaction by wanting to wait and see the inflationary effects of the lira’s recent depreciation.

In other words, CBT are adopting the ostrich strategy of sticking their heads in the sand and hoping for the best. This is not an advisable strategy. Inflationary pass through dynamics are especially elevated in Turkey precisely because the central bank implicitly favor weaker exchange rates in the hope of bolstering growth.

Consequently inflation expectations remain elevated and illustrate a high correlation with lira exchange rates. This is to say nothing of external factors. The paradigm shift in long end DM interest rates and the USD implies further upside for USDTRY.

It’s not beyond the realms of possibility to expect a fully blown currency crisis in Turkey in the New Year if CBT’s approach doesn’t change. Markets seem to agree; USDTRY back end volatilities are increasing notably. Put simply, either you deal with a problem or the problem ends up dealing with you.

This central bank’s decision has kept the USDTRY’s long lasting bullish rout. You could this in technical charts that major uptrend has been restrained at 3.5971 levels, swings are going in sideways ever since then.

Technically, the bullish momentum reduced but upswings consistently spiking higher above DMAs, hence, we reckon that despite there is shrink in momentum, the major uptrend has been robust. You could figure out the intensity in weekly charts that signifies the price action, volumes and technical indication by both RSI and moving averages that signal bullish convergence.

So, our strong conviction is that bull trend is likely to prolong in the weeks to come.

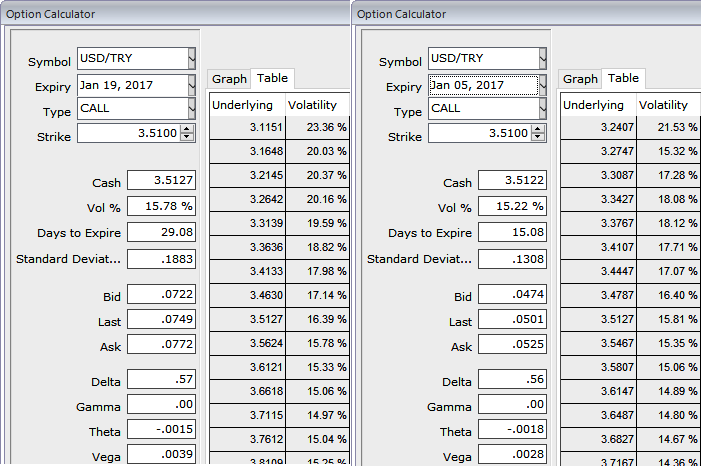

Please be noted that the ATM IVs of 1m and 2w are spiking on higher sides at 15.78% and 15.22% respectively, against a backdrop of a widening current account, ongoing political risks and rising oil prices, we remain firm with bullish bias and hold USDTRY 1x1 call spreads (3.5050, 3.70) which is a debit call spread, at spot ref: 3.5117 levels.

The only positives for lira here, in our view, are extended short speculative lira FX positioning, which likely remains in place even following the short squeeze earlier this week.

Additionally, we understand the government is encouraging state institutions to convert FX holdings into lira. Both of these sources of support are likely to prove limited and can only slow rather than reverse the lira slide, in our view.

Acknowledging the positioning, we continue to hold 1x1 call spreads, however following the government’s package there is now a larger risk of a more aggressive sell-off. Continued non-resident outflows from the local bond market are also likely to drive further TRY weakness.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.