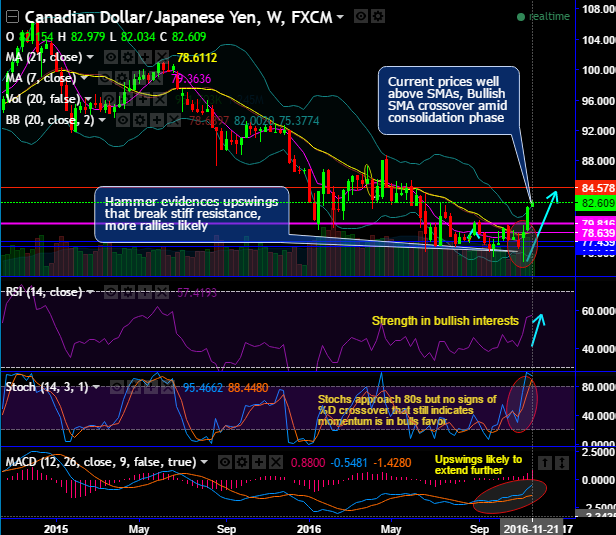

On weekly terms, this pair forms hammer pattern candle at 78.718 level which is bullish in nature, you could see that this hammer pattern now evidences upswings that break the stiff resistance of 78.639 and 79.816 levels, more rallies likely to head towards next strong resistances of 84.578 levels.

RSI on daily terms: Upward convergence to the price upswings signals the strength in bullish interests.

Stochastic on daily terms: Stochastic curves approach 80s but no clear signs of %D crossover that still indicates momentum is bulls favor.

MACD: bullish crossover indicates the prevailing upswings likely to drag further.

Current prices jump above DMAs, 7DMA has crossed over 21DMA which is a bullish signal.

On broader perspectives, the current price jumps above 7EMA and breaks strong resistance at 79.220, more upswings likely but confirmation needed by lagging indicators.

RSI on monthly terms: You could probably make out the divergence to the major downtrend that would imply that there could be some upside potential in short run, but this should not be deemed as the reversal trend.

Stochastic: To substantiate the bullish stance, %K crossover indicates intensified bullish momentum.

Although we’ve been seeing price behavior that seems like consolidation phase from last 3-4 months, MACD and moving averages are yet to confirm these bullish signals on monthly terms.

Overall, short term longs are encouraged, while long-term bulls for fresh longs are yet to for the better clarity.

But on intraday speculation purpose, contemplating above technical reasoning, we could foresee equal chances for both bears and bulls.

The FxWirePro Canadian dollar index weakened but Japanese Yen index indicates more bearish environment on account of today’s retails sales data in Canada, that is printed disappointing number (actual 0.0% versus forecasts at 0.6% and previous 0.2%).

Hence, double touch option is useful for intraday traders who believe the price of an underlying asset would undergo a large price movement, but who are unsure of the direction.

A trader can use a double touch option with barriers at 82.979 and 82.282 to capitalize on this outlook.