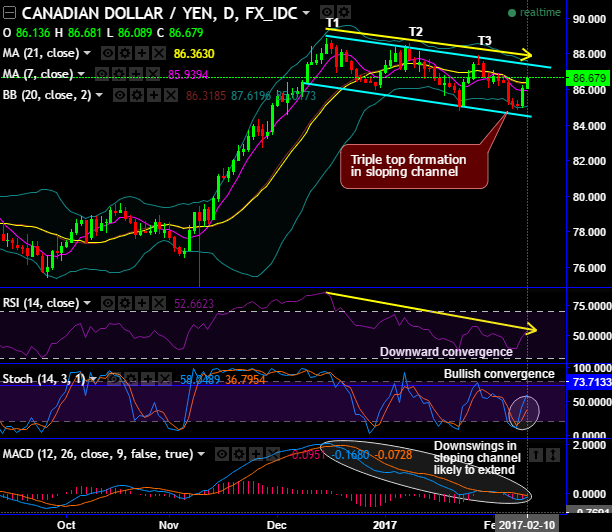

On daily terms, the pair has formed the triple top pattern with top 1 at 88.925, top 2 at 88.660 and top 3 at 87.973 levels with a gravestone doji formation.

The prices gradually have been sliding after triple top formation in the sloping channel.

But the interim bulls have been showing a little strength in rallies at channel baseline despite this bearish pattern.

On the broader perspectives, interim bulls struggling to clear stiff resistance at 88.919 (you can observe historic price behavior at the same juncture), subsequently, the spinning top occurred at the same levels.

RSI on daily terms: Consistent lower lows signals downward convergence to the price dips. But showing little strength in bull swings at 36 levels.

Stochastic on daily terms: Stochastic curves evidence %K crossover at 20 level that indicates momentum in bulls favor.

MACD: This indicator has been indecisive but entered below zero level that signals price dips likely to drag further.

RSI on monthly terms: You could probably make out the divergence to the major downtrend that would imply that there could be some upside potential in short run, but this should not be deemed as the reversal trend as the strength in interim bull trend is losing strength at around 62 levels.

Stochastic: %K crossover even 80 levels indicate intensified bullish momentum.

Although we’ve been seeing price behavior that seems like consolidation phase from last 4-5 months, MACD and moving averages are yet to confirm these bullish signals on monthly terms.

Although the current price jumps above 21EMA, any breaks above strong resistance at 88.919 and bullish EMA crossover are awaited as the better clarity for the long term buying sentiments, more upswings likely but confirmation needed by both leading and lagging indicators.

Overall, short term longs are encouraged, while long-term bulls for fresh longs are yet to for the better clarity.

But on intraday speculation purpose, contemplating above technical reasoning, we could foresee equal chances for both bears and bulls.

Hence, below boundary binary options are advocated that is suitable at this juncture.

Trading tips:

For intraday trading perspective, it is advisable to buy boundary binaries on dips upper strikes at 86.954 and lower strikes at 85.919. One can fetch leveraged returns to the yields as long as underlying spot remains between above expiries on expiration.

The FxWirePro Canadian dollar index weakened but Japanese Yen index indicates more bearish environment ahead of today’s Canadian unemployment claims.