Bearish: CADJPY scenarios driven by:

1) NAFTA renegotiations break down and breakup fears return.;

2) US growth expectations upgraded on policy driving a broad $ rebound

3) The global investors’ risk aversion heightens significantly

4) The expectations for more hawkish than expected stance of the BoJ if inflation expectations heighten

Bullish: CADJPY scenarios driven by:

1) Local oil prices remain sustainably above $60/bbl triggering a renewed investment cycle

2) The dovish shift of the BoJ monetary policy, resulting in higher stock prices and JPY depreciation.

3) Severe deterioration of US politics and geopolitics dent US growth expectations and further widen out the broad dollar discount much further

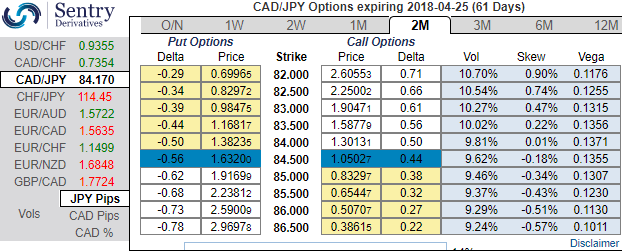

OTC outlook and FX options strategy: Option strips (CADJPY)

CADJPY is one of the better candidates since recent CAD weakness has undershot recent moves in oil and rate spreads.

Well, please be noted that the positively skewed ATM IVs of 2m tenors indicate the hedging interests of OTM put strikes upto 82 levels.

Technically, we’ve already stated in our recent write up, the current week prices slid well below 21EMA levels with bearish crossover and broken wedge baseline with intensified bearish momentum, thereby, one could expect more slumps as both the leading oscillators have been constantly converging downwards to signal weakness (refer our post on technical section).

To factor-in all above stated driving forces, we reckon that the underlying pair has equal chances of moving on either side but with more potential on downside, accordingly, it is wise to initiate longs in 2 lots of 2m ATM -0.49 delta puts, simultaneously, add long in 1 lot of +0.51 delta call of the same expiry, the payoff function of the strategy is likely to derive positive cashflows regardless of swings but more potential from the underlying spot FX moves towards downside.

The risk is limited to the extent of premium paid to buy the options.

The reward is unlimited until the expiry of the option.

Please note that the trader can still make money even if he was wrong, that means the strategy likely to derive handsome yields in premiums regardless of swings. But the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above 9 levels (neutral), while hourly JPY spot index was at 71 (bullish) while articulating (at 07:33 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand