The bearish CADJPY scenario below 79 driven by:

1) The US moves ahead on border adjustments or NAFTA negotiations turn sour;

2) US-Canada trade negotiations turn acute and negative with a proliferation of high-profile trade enforcement actions by the US;

3) Commodity prices fall much further on China/global growth concerns;

4) Wobbles in the housing market cause a broader instability in the financial system.

The bullish CADJPY scenario above 87.092 driven by:

1) BoC indicates the intention to normalize rates earlier due to an improved global outlook.

2) Global demand pushes oil prices well above $60.

CADJPY is one of the better candidates since recent CAD weakness has undershot recent moves in oil and rate spreads

Hedging Strategy: Option strips (CADJPY)

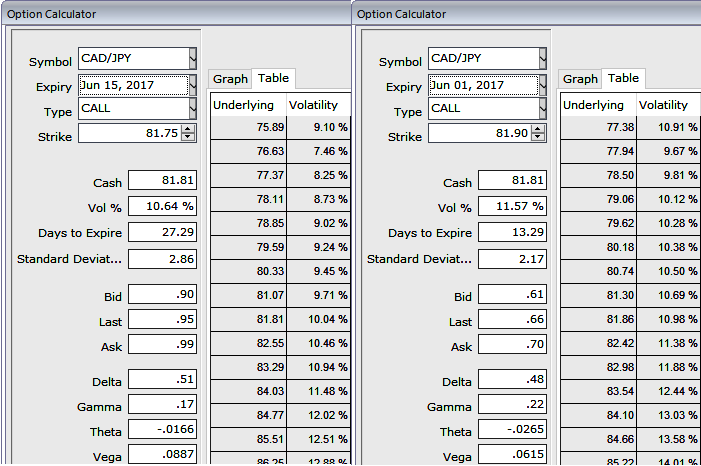

Please be noted that the ATM IVs of this pair has been inching higher at 11.57% and 10.64% for 2w and 1m tenors respectively. The higher IVs have been the good news for option holders.

Go long in 2 lots of 2w ATM -0.49 delta puts, while long in 1 lot of +0.51 delta call of the same expiry, See that payoff function the strategy likely to derive positive cash flows regardless of swings but more potential from 2 puts are more than 1 call.

The risk is Limited to the price paid to buy the options.

The reward is Unlimited till the expiry of the option.

Please note that the trader can still make money even if he was wrong, that means the strategy likely to derive handsome yields in premiums regardless of swings. But the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data