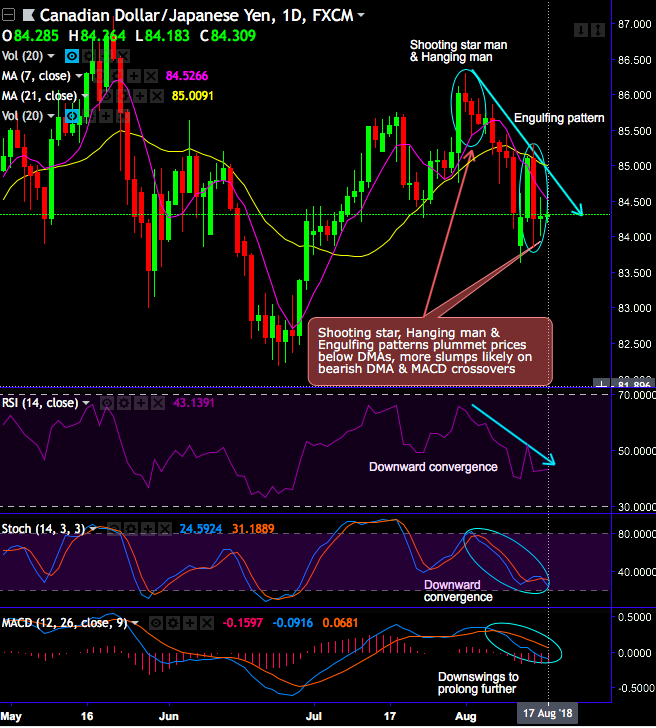

On daily plotting of CADJPY, Shooting star, Hanging man & Engulfing candlestick patterns have occurred at 85.904, 85.723 and 84.263 levels plummet prices.

For now, the stiff resistance zone is observed at 84.5260 levels (i.e. 7DMA), more slumps likely on bearish DMA and MACD crossovers that has taken off slumps below 7 and 21 DMAs.

Both momentum oscillators (RSI & Stochastic curves) are indicating the intensified bearish momentum. Whereas the trend indicators (DMA and MACD) signal downswings to prolong further.

On a broader perspective, the major downtrend has gone in consolidation phase since December 2015 (refer monthly plotting for range-bounded trend). Shooting star pattern has occurred at 83.969 levels hampers previous bullish momentum on this timeframe.

Trade tips: Well, on trading perspective, at spot reference: 84.302 levels, it is advisable to buy tunnel spreads using upper strikes at 84.5260 and lower strikes at 84.002 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX keeps dipping but remains above lower strikes on expiry duration.

Alternatively, on hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 83.500 levels in the near terms.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly CAD spot index is inching towards -69 levels (which is bearish), while hourly JPY spot index was at -51 (bearish) while articulating (at 05:48 GMT). For more details on the index, please refer below weblink: