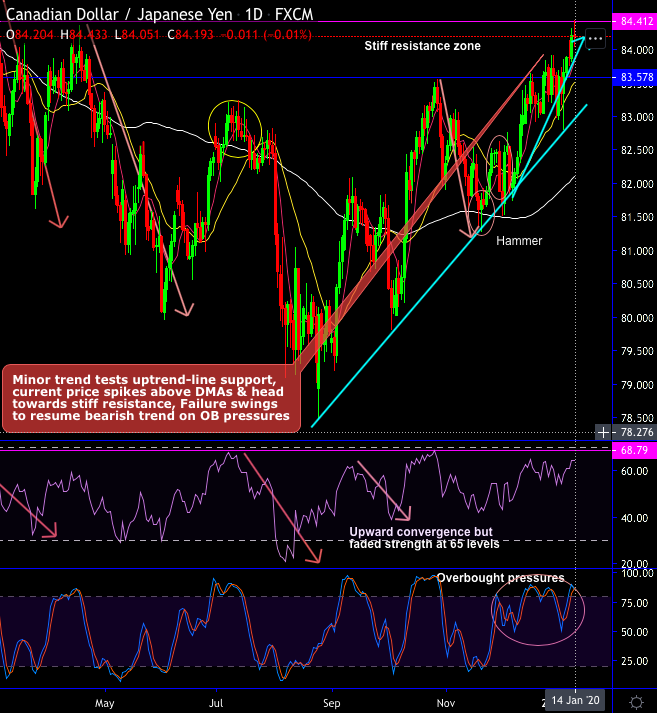

CADJPY major trend has been sliding through downtrend line (weekly chart) and minor trend is spiking with uptrend line (refer daily chart). Bulls have tested uptrend line support with hammer and bullish engulfing patterns, consequently, bounced back above 7 & 21-DMAs with bullish crossovers in the minor trend of this pair.

Although bulls attempt to bounce back after testing trendline support, the minor trend still appears to be edgy on the overbought pressures and the failure swings were observed at the stiff channel resistance several times in the recent past. Consequently, bears bring swings back in channel.

While there is no change in our long-term outlook, the major downtrend remains intact. On a broader perspective, the major downtrend of this pair which has been in the consolidation phase since December 2015 has now been signalling weakness again upon the downtrend line formation and head & shoulder pattern (refer monthly plotting).

Head at 91.638, left shoulder at 88.922 and right shoulder at 87.851 levels. Shooting star pattern pops-up at that juncture hampers previous bullish momentum on this timeframe.

Ever since the formations of shooting star and bearish engulfing patterns at 84.120 and 82.819 levels respectively on monthly plotting, we witnessed steep slumps thereafter. Overall, the major trend seems to be weaker both momentum oscillators (RSI & Stochastic curves) and bearish EMA & MACD crossovers are in bears’ favor.

Trade tips: Well, upon above technical rationale we alter our trading perspective, at spot reference: 84.122 levels, contemplating above technical rationale, it is advisable shorting futures contracts of mid-month tenors on hedging grounds, as the underlying spot FX likely to target southwards 78 levels in the medium terms.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.