The supply disruptions inflicting the oil market continue to ratchet up. Canadian output looks likely to be impacted much longer than expected by ongoing wildfires. Manufacturing sales in Canada was worse than anticipated (actual -0.9% versus -0.7%), on the flip side, Japanese preliminary QoQ GDP prints are better than expected (actual +0.4% verus +0.1% & previous -0.3%).

Data front, Canada is scheduled to be announced their CPI and retail sales on Friday.

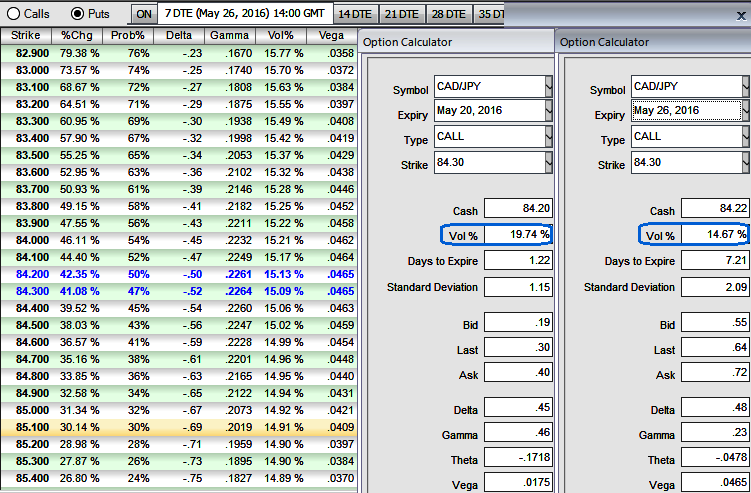

The current implied volatility of CADJPY ATM contracts is at 19.74%, likely perceive at 14.80% for of 1W tenors. While, OTM put strikes have healthy probabilistic and vega numbers with rising IVs. This would imply that the put contracts of these strikes are most likely to finish in the money on expiration.

So, shorting expensive OTM or ATM calls during such bearish situations with shorter expiries would likely result in positive cash flow on expiration as ATM IVs are likely to fade away in short run.

Hence, we capitalize on reducing IVs and downtrend such beneficial instruments and deploy in the below strategy.

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute:

Go long in CADJPY 1M at the money delta put, Go long 1M at the money delta call and simultaneously, Short 1M (1%) out of the money call with positive theta.

If one is bearish to very bearish, then one can even eye on writing ATM or ITM calls as well as an alternative to shorting the underlying spot FX.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022