The escalation of US-China trade tensions has been a key driver behind the rising volatility in the metals complex. As global trade tensions heat up, the potential impact could be two-fold.

On one side, our forecast of above-trend global growth is being increasingly challenged as an escalation in global trade tensions will bring with it significant supply shock to the world economy, rising inflation and lowering growth.

The indirect effect of trade wars is the loss of confidence, resulting in corporate and household retrenchment that eventually leads to the generalized tightening in financial conditions; we particularly see the start window for an intermediate Precious Metals rally open.

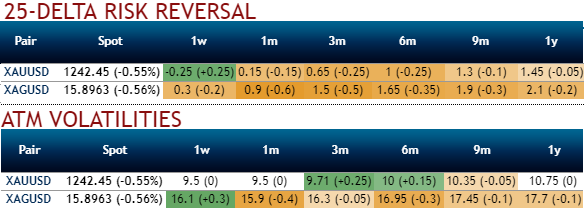

While 2m IV skews have been well balanced on either side and signify the hedgers’ interests on both OTM call and put strikes. While the combination of 1m bearish neutral remains intact with shrinking IVs is conducive for writing overpriced OTM calls. Using three-leg strategy would be a smart move to reduce hedging cost.

While it is reckoned that as per the OTC indications as shown above and the prevailing trend in bullion markets seem to be reasonably addressed by hedging participants, thus, we advocate below option strategy to keep uncertainty in spot gold prices on the check. On trading perspective also, the strategy likely to fetch positive cashflows regardless of underlying price swings with more potential on the downside and with cost-effectiveness.

While the risk-averse traders who are dubious about upside move, accordingly, initiate longs in XAUUSD 2M at the money -0.49 delta put, and go long 2M at the money +0.51 delta call and simultaneously, Short 2w (1%) out of the money calls. Thereby, we favour bulls as we foresee more upside risks by keeping longer tenors on call leg.

On the back of our forecasted FX-driven strength in gold, we still believe silver likely to outperform, given its industrial linkages and technical set-up.

On the industrial front, while global economic growth has turned relatively less synchronized and more uneven, we still retain the base case that we are in the latest ages of this economic expansion, one of the strongest periods for both demand and prices of industrial commodities.

We believe that while silver’s main drivers for the price will still be precious-specific catalysts like FX, real-yields, and inflation, this secondary industrial tailwind could once again excite investors and drive the ratio between the two metals lower towards 76 as silver outperforms gold.

Moreover, as our technical analyst has detailed, above $16.02/oz the upside window to $19.63/t remains wide open from a technical perspective which we also believe could help fuel silver outperformance.

Initiated longs in silver futures contract for Dec’18 delivery at $17.10/oz in earlier February 2018. Added an equivalent unit at $16.59/oz in March again for a new entry level of $16.85/oz. Trade target is $19.37/oz while we have lowered our stop to $15.70/oz. Courtesy: JPM.

Currency Strength Index: FxWirePro's hourly USD spot index is at shy above -123 levels (which is bearish) while articulating (at 13:11 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty