Bullish scenarios USDJPY to 125 if: 1) The strong US growth leads aggressive Fed hikes and a spike in UST yields, resulting in broad USD strength, and

2) Japanese government’s fiscal policy becomes more expansionary and the BoJ finances it, resulting in higher Japan’s inflation expectations

Bearish scenarios USDJPY to 100 if:

1) The global investors’ risk aversion heightens significantly,

2) The weak US economy dampens hopes for Fed hikes and leads broad USD weakness, and

3) Expectations for more hawkish than expected personnel change of the BoJ heighten.

BoJ is scheduled to for its 1st monetary policy announcement in 2018. The latest development of JPY that caught market attention was its appreciation upon the BoJ’s announcement to decrease purchases of super-long bonds on January 9.

Well, it is reckoned that this would not be a game changer for yen in a mid-to-long-term as the purchase amount has already trended lower over time and the purchase amount is no longer the main target of monetary policy of the BoJ (Chart 1). We consider the appreciation as a knee-jerk reaction and a part of position correction given that JPY short positions, especially through crosses, were stretched.

Speaking of the BoJ, the bank’s personnel change will rather be in focus in January and February as Governor Kuroda's term will expire in April and Deputy Governor Iwata and Nakaso will end their terms in March. While the consensus and we expect Kuroda to be reappointed as Governor, headlines related to possible candidates will possibly impact JPY.

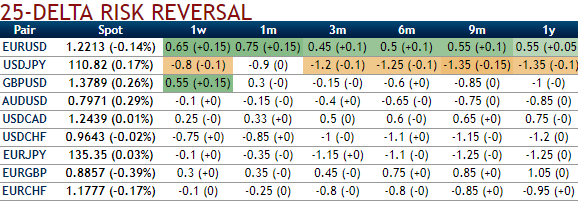

The implied volatility of ATM contracts of USDJPY is trading at around 7.28-7.62% for 1-3m tenors, as the delta risk reversals flashing up progressively with negative numbers that signify the hedging sentiments for downside risks over the period of time, this appears to be conducive for put option holders. Positively skewed IVs of 3m tenors are also of the same indication.

Thus, we advocate buying USDJPY 1y put spread strikes 106/103, global knock-in 116 Indicative offer: 0.33% (vanilla: 0.75%, spot ref: 111.11).

Currency Strength Index: FxWirePro's hourly USD spot index has shown -110 (which is highly bearish), while hourly JPY spot index was at -35 (bearish) while articulating at 06:27 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed