Bearish scenarios: we foresee the pair going below 1.09 if

1) The market prices in three Fed rate hikes in 2018; or

2) Non-traditional parties appear to prevail in German or Italian elections.

Bullish scenarios: we foresee above 1.18 if

1) Equity inflows accelerate into the region;

2) Trade protectionism delays Fed tightening;

3) The US initiates a trade war with China, Mexico, Japan or the EU,

4) ECB becomes more hawkish.

EURUSD is upgraded outright (3Q at 1.16 from 1.08 (it has already achieved); 2Q’18 at 1.18 from 1.16).

Technically, the upswings in the major trend likely to head towards above range resistance of 1.16, and heading towards 2-years highs of 1.1714 levels for now.

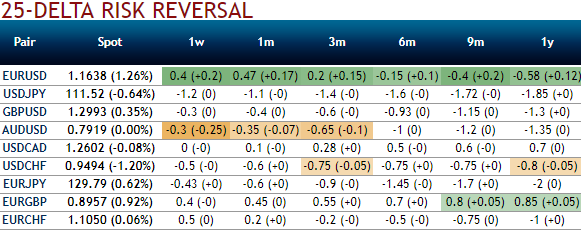

OTC updates:

Please be noted that the EURUSD 1-3m RR has currently turned into positive flashes to mitigate bullish risk sentiments, while the 3m and 1y are lower than one vol for EUR puts. Crossing the line whereby euro calls become more expensive than puts may not be that far away. While the positively skewed IVs of 1m tenors signify upside risks of the underlying pair.

EURUSD risk reversals, in the recent past, have flipped onto calls from puts. A positive RR means that the euro tend to appreciate faster than it falls, reflecting the durable positive correlation between the dollar’s level and its volatility.

This is what happened when the Fed embraced exceptional monetary easing. But the ongoing monetary switch, coupled with choppy exits in both the US and EU, could switch the dollar/vol correlation if the dollar declines in a disordered way.

Indeed, EURUSD Vega will perform if the terminal fed funds rate peaks lower than expected while the market discounts a tighter ECB, since the 6m vol is strongly correlated with the ECB vs Fed rates spread.

That has resulted in positive EURUSD risk reversals, or at least put an end to a persisting negative skew, with frequent flips from now onwards.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes