Bearish GBPJPY scenarios:

1) The BoE passes on a May hike;

2) Core CPI continues to moderate and wages remain sticky below 3%;

3) The UK and EU fail to agree on the Irish border, leading to a non-negotiated Brexit);

4) Overt UK balance of payments pressure

5) Prime Minister Abe steps down

Bullish GBPJPY scenarios:

1) A Parliamentary majority in favour of customs union membership frustrates a hard Brexit;

2) Rejection of the withdraw a bill in parliament precipitates fresh election and/or 2nd referendum

3) The BoJ does not move even if core inflation rate rises more than expected.

GBPJPY has been spiking more than 21EMAs in the consolidation phase in the major declining trend. However, one month has been enough to wipe-off previous 5-months’ rallies (refer monthly plotting for February’s price slumps). This shows the intensity of the major declining trend.

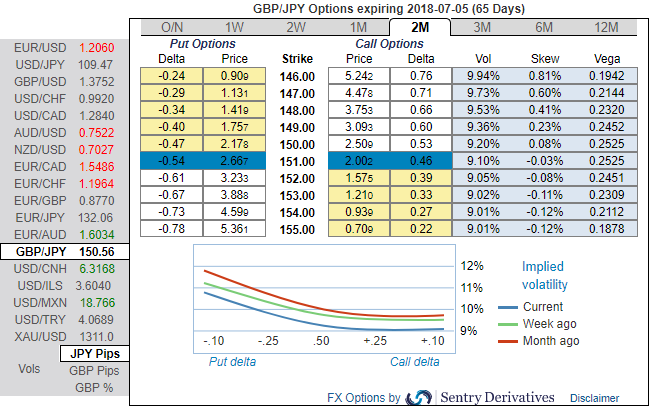

OTC updates: The OTC indications are also substantiating this bearish stance, let’s glance at the positively skewed IVs of GBPJPY of 2m tenors signify the mounting hedgers’ interests in OTM put strikes (bids upto 146 levels) and isn’t this a luring factor for a shrewd bear. While 2w/2m IVs of ATM contracts are trending above 9.25% that are the suitable combinations for diagonal ratio spreads structures.

Because the higher IVs with well-adjusted positive skewness signify the hedgers’ interest for both OTM call/put strikes. In usual circumstances, long option position needs higher IVs for significant change in vega. Hence, we capitalize on buzzing IVs in 2m tenor for long leg and improve odds on options below strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility. Thus, ATM strikes are perceived to be more conducive than the OTMs.

Options Strategies: Any further GBPJPY upswings and/or weakness suggest building directional strategies as given below and volatility patterns at the same time.

1) In order to mitigate the mounting downside risks and keep them on the check, we advocate adding longs in 2 lots of (1%) OTM -0.49 delta puts of 2m tenor, while writing 1 lot of 1% ITM put of 2m tenor. Payoff structure of this strategy has been exponential as the underlying spot FX keeps dipping (refer above payoff table).

Contemplating IV skewness and ongoing technical trend, we foresee the value of ATM options would likely rise significantly as the IVs seem to be favoring long legs of ATM strikes.

2) Dubious and risks averse traders, we advocate buying GBPJPY – USDJPY 1Y ATM straddle spread with equal JPY vega.

3) Alternatively, on hedging grounds, we advocate shorting futures contracts of near-month tenors as the underlying spot FX likely to target southwards 145 levels in the near run and 146 levels in the medium run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch