Bullish and bearish scenarios of USDMXN:

Bullish scenario: USDMXN could be seen at 20 over 2H’17 on a putative disorderly renegotiation of NAFTA, de-anchoring inflation expectations leading to bond outflows and local politics volatility.

Bearish scenario: USDMXN at 17.5 in 2H’17 on strong momentum for the MXN, a weaker USD and inflation peaking and subsequently declining from the highs, in which case Banxico would end the tightening cycle and portfolio inflows would likely be strong.

In Latam, we are neutral overall but the upgrade to MXN is notable (USDMXN year-end at 18.50 from 19.80).

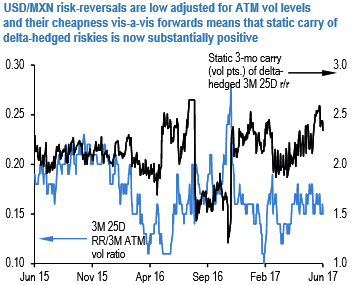

The peso has come a long way from its Trump lows and screens overbought and overvalued at current levels, leading our LatAm team to turn underweight recently. The standout feature of the USDMXN vol surface to us is the cheapness of risk-reversals, both vis-à-vis ATM vols and particularly relative to the amount of carry in forwards (refer above chart) that allows for carry efficient expressions of bearish directional views or tail risk hedges.

The telling statistic from the graphic is that that the static carry of delta- hedged vega-neutral 3M 25D skews is a very substantial 2.5 vol pt., near the upper-end of its 2-yr range.

For investors already MXN, collaring the existing cash exposure via an overlay of purchased risk-reversals is a compelling proposition, as an increase in core G7 rates has the potential to trigger a correction in the consensus long EM trade predicated on low-for-long monetary policy and contained volatility.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different