The recent euro stability belies in its structural vulnerability to more debt & less growth, EUR, against majors, is uniquely susceptibility to a sharp increase in public sector debt levels due to the uneven debt burden within the region and the absence of a mechanism, and indeed seemingly still the political will, to effect material fiscal transfers that would put the sustainability of high-debt, low-growth countries beyond question. While we are listing out some important driving forces of EURCAD in this write-up and suggested suitable hedging vehicles.

Bearish EURCAD Scenarios:

1) A second Covid-19 wave that does further damage to public finances.

2) Continued failure of Euro area governments to agree joint fiscal issuance or material fiscal transfers to fund economic rebuilding.

3) Italy loses investment grade status.

4) UK leaves the EU at year-end with no trade deal.

5) GCC blocks Bundesbank participation in QE.

6) The COVID-19 downturn is a true v-shaped recovery.

Bullish EURCAD Scenarios:

1) Political progress towards debt mutualisation and/or more significant fiscal transfers as part of the recovery plan.

2) All countries tap the ESM facility and the ECB stands ready to activate the OMT facility.

3) ECB aggressively expands PEPP in support of peripheral markets.

4) The UK extends its transition period for Brexit beyond end-2020.

5) The global sudden stop catalyses a large capital outflow given Canada’s BoP deficits

6) Renewed oil price war accelerates industry-wide crude production shut-ins.

OTC Indications:

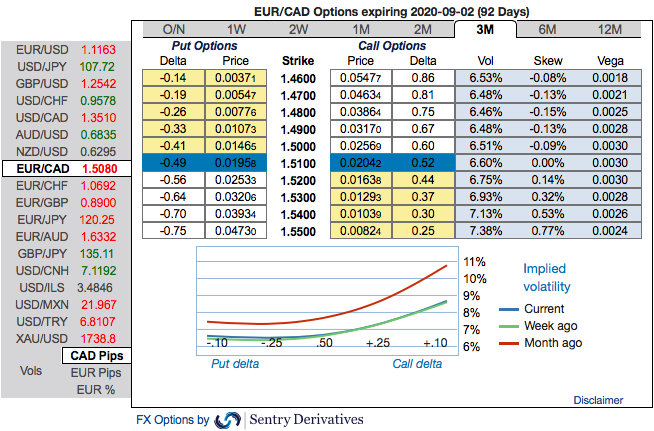

While positively skewed IVs of 3m tenors of EURCAD contracts have also been indicating upside risks, bids for OTM Calls are on high demand as the hedging sentiments for upside risks are intensified (refer above nutshell).

Because of the comatose state of currency markets at present, CAD option risk premia appear oblivious to the fallout of this high stakes standoff. EURCAD risk-reversals in particular appear too complacently priced: at zero across the curve, they are well discounted to already low USDCAD risk-reversals (3M 0.35, 1Y 0.7), and under-priced relative to even tepid recent realized spot- vol correlations (SABR implied 6M spot-vol corr. in EURCAD r/r 1% vs. trailing 1m spot-vol corr 15%).

Hedging Strategies:

BoC and ECB monetary policies are scheduled for this week and they are most likely to maintain status quo at this juncture.

The underlying price of this pair has slid a bit and has further downside potential in the near-terms but major uptrend remains intact.

Hence, 3m (1%) +0.70 delta in the money call option seems to be the most suitable strategy for EURCAD contemplating some OTC sentiments and monetary policy events.

Alternatively, we advocate shorts in EURCAD futures contracts of June’2020 delivery with a view of arresting abrupt price slumps and simultaneously, add longs in futures July’2020 on hedging grounds for potential resumption of the major uptrend. Thereby, one can directionally position in their FX exposures. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately. Courtesy: Sentry & JPM

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand