The formal start of Brexit negotiations on Monday may prove more of a catalyst for the pound than an inconclusive general election, a surprise hawkish shift by Bank of England officials and a spate of disappointing economic data.

Despite the raft of surprises to hit Sterling this month, it’s set to record its tightest monthly range versus the euro since 2014. That may change as, almost one year since Britain voted to leave the European Union, U.K. Brexit Secretary David Davis and his European counterpart Michel Barnier open negotiations. The talks started with a “positive and constructive” tone, Davis said on Monday.

The two sides will hammer out how talks will be structured, whether there would be a transitional phase to help businesses to re-adjust to new rules and what the divorce would mean for rights of EU citizens living in the U.K. and Britons living on the continent.

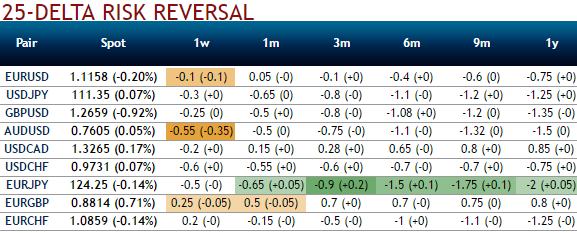

Long 1Y GBPUSD 1.42 put vs 1.6175 call (1Y risk reversal).

Options traders are more bearish on the pound than any other Group-of-10 currency over the next three months, according to risk-reversal data. The case for turning positive on the pound still eludes most market participants. Robeco Investment Solutions’ portfolio manager Jeroen Blokland said he has initiated a long position in the euro against sterling as “there is a chance Brexit could turn ugly.”

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data