The British Government’s decision to trigger Article 50 and start the process of leaving the EU is making all the headlines, of course. But the wider market story is that yet again, volatility ahs collapsed. Both the Vix, and Deutsche Bank’s CVIC FX volatility index, are back below their 50, 100 and 200-day moving averages.

The excitement that was caused by the failure of President Trump’s healthcare bill has been washed away as bond yields stabilize. A 2.42% 10-year note yield is neither too hot nor too cold, consistent with a couple more rate hikes this year but not with the Fed’s famous dots that take rates to 3% in due course.

Rates stay below the nominal growth rate of the economy and asset prices take comfort. Both the dampening effect on volatility and the over-correlation of financial markets that Helene Rey described as the result of too-low rates are back as the dominant force behind markets.

In FX, that’s a recipe for yield hungry, risk-tolerant investors to take the lead. So, the Article 50-triggering letter is signed and will be handed over at 12:20 BST.

The pound’s down about half a percent though there’s no logic in that. Today’s ceremony changes nothing. A divided Great Britain decided to leap lemming-like into the sea months ago, led by a Prime Minister who promises a bright future but has no clear roadmap showing us to get there.

Sterling, in trade-weighted terms, is very cheap. But then real bond yields, in absolute and relative terms, are very low (even if they’re now just above -2%). And until we get Q4’s data, the current account deficit is huge at 5.1% GDP (it will get smaller in Q4 but it will still be huge). Where the pound goes now depends to a very large degree on economic data. The political shock is surely mostly priced in. But the danger is that the economy slows even as the UK has a sticky inflation rate.

That would leave the MPC navigating sot growth and a bit of inflation, and leave UK real rates and yields anchored while elsewhere -notably in a resurgent Eurozone – they rise.

That is why we remain bullish of EURGBP over the medium term. The dangers to that trade, French politics and UK economic resilience, both seem smaller than the likelihood we have a serious look at parity between the pound and the euro in the years ahead.

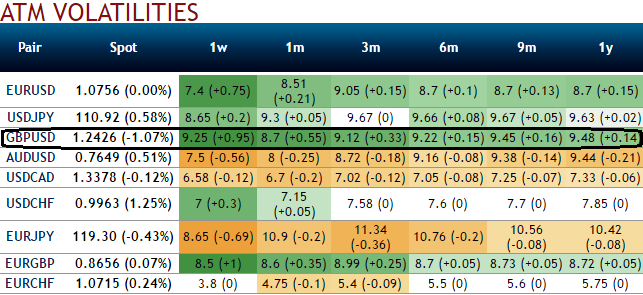

The IVs and delta risk reversal of across all tenors indicate hedgers have been ready to pay high premiums on OTM puts in longer time horizon.

With rising IVs above 9.12% for 3 months expiries and a tad below 9.5% for 1y tenors having significance in economic drivers that propels this currency pair to anywhere.

While OTC volumes volume index for GBPUSD has a steep increase and it is the maximum.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand