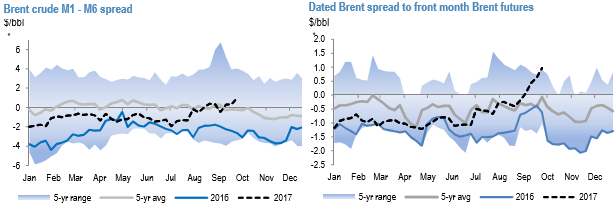

As a result of the bid from refineries in Atlantic Basin, crude markets have tightened further in recent weeks as still-healthy refining margins have lifted demand for crude. However, as we approach the end of 3Q’17 we expect this effect will likely fade. Nevertheless, Brent crude structure is back to levels last seen in mid-2014, (refer above diagram), as is Dated Brent pricing relative to front month Brent Futures, (refer above diagram).

The latter aspect of the cash crude market strength appears particularly bullish for outright prices. The discount, or premium, that Dated Brent can command relative to futures is a key measure for the tightness of the physical crude market. Typically, refineries will only pay a premium for cash cargoes –as measured by Dated Brent – versus the screen if it makes financial sense when they process the crude. Hence, a premium in this market implies genuine tightness that cannot be offset by economic run cuts or crude stocks draws. We view this development as a short-term cyclical support for prices.

We view the majority of the recent upswing in Brent crude futures structure as a cyclical response to the tightness in product markets following the loss of refinery supply from the US Gulf Coast.

As noted ahead of its landfall, USGC refineries are far more interlinked with international oil markets than the last time the market had to accommodate this scale of disruption.

While margins have largely normalized to pre-hurricane levels, they remain strong and the building evidence of stronger than anticipated demand growth could propel prices higher in the short term, even if much of the current tightness in crude and products markets could unwind as we start 4Q’17.

American Petroleum Institute is scheduled to announce its weekly report at 20:30 GMT, as speculators continue to ponder how would be influence of recent storm action was on demand/supply equation.

Brent futures, the benchmark for oil prices outside the U.S., shed 0.7% to $58.03. It reached a 26-month peak of $58.88 earlier in the session.

We encourage longs in the Brent $50-45/bbl put spread of December 2018 expiries. The put spread position for an initial premium of $2.10/bbl.

We reckon that prices would soften in 2018. Despite positive news flow surrounding this week’s Joint Monitoring Committee meeting, there appears limited appetite for additional production cuts. Even if prices rally in the short term, it appears an attractive risk-reward to be long this put spread for end 2018 pricing. Courtesy: JPM

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed