BoE is scheduled for monetary policy on this Super Thursday

Lots of bad news is priced in and lots of bad news is likely. We expect three years of real GDP growth below 1% in 2018-2020, averaging 0.8% per annum, about a quarter of the world’s average growth rate.

On a positive note, that ought to be enough to shrink the current account deficit to under 2½% GDP, but that’s a Pyrrhic victory.

We expect the Bank of England’s MPC to keep rates on hold through 2018 and, ultimately, to be forced into further easing, against a backdrop of tighter policy elsewhere. All of which will anchor sterling.

OTC outlook and Hedging Perspectives (GBPJPY):

Overall, GBPJPY has been edgy at 152.121 levels ever since the occurrence of hanging man pattern candle which is bearish in nature, we anchor the prevailing bearish stance of is backed by both leading oscillators, one can think of shorts in this pair only for the short-term basis. For more readings, refer our technical section:

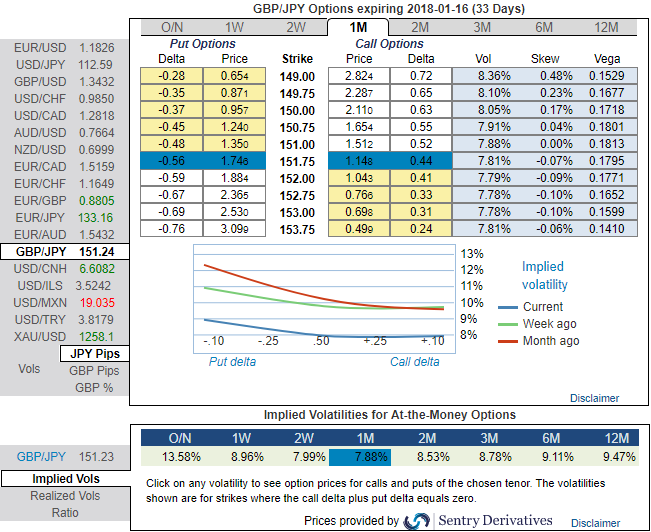

Please be noted that the positively skewed IVs of GBPJPY of 1m tenors signify the hedgers’ interests in OTM put strikes (upto 149 levels). While 1w/1m IVs of ATM contracts are spiking above 8.96% and 7.88%.

The higher IVs with well-adjusted positive skewness signify the hedgers’ interest for both OTM call/put strikes. In usual circumstances, long option position needs higher IVs for significant change in vega. Hence, we capitalize on buzzing IVs and improve odds on options below strategy.

With this interpretation, one can judge whether the options with a higher IV cost more. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good.

Thus, we advocate weighing up above aspects as we eye on loading up with fresh vega longs for long-term hedging, more number of longs comprising of ATM instruments and deep OTM call shorts with narrowed tenors would optimize the strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility. Please glance through sensitivity table for the ATM and OTM pricings, ATM puts are trading at 10.66% and OTM puts are at 30.6%. Thus, ATM strikes are perceived to be more conducive than the OTMs.

Further GBPJPY upswings and/or weakness suggest building a directional strategies and volatility patterns at the same time.

In order to mitigate downside risks and keep them on the check, we advocate adding longs in 2 lots of ATM -0.49 delta puts of 1m tenor while writing 1 lot of 2% OTM put of 1w tenor.

Contemplating IV skewness and ongoing technical trend, we foresee the value of ATM options would likely rise significantly as the IVs seem to be favoring long legs of ATM strikes.

Currency Strength Index: Ahead of the BoE’s monetary policy announcement, FxWirePro's hourly GBP spot index is flashing at -2 (neutral), while hourly JPY spot index was at shy above -26 (bearish) while articulating at 07:25 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target