The Mexican peso has come under depreciation pressure once again and this provided a first taste of what we are likely to face over the coming days.

We expect MXN to stabilize around 18.80 on domestic and NAFTA considerations. We mentioned MXN hedges at these levels were no longer necessary, yet admittedly further high-carry FX weakness will continue to spill-over into MXN as the typical hedging currency for the asset class.

On Wednesday the fifth round of the NAFTA renegotiations will start – two days before the originally planned date – it will run until 21st November. This round is not likely to be easy either. Controversial issues such as rules of origin, where the US demand a high US-share, will have to be negotiated.

That means the market is likely to remain nervous as there is a risk that the negotiations could fail and the free trade agreement will come to an end, which could drive the Mexican economy into a severe crisis.

Should an agreement be reached unexpectedly, the peso would of course quickly retrace the losses recorded over the past weeks, but at the moment it does not look as if that was going to happen.

Banxico’s announcement to intervene with an additional $4bn should also limit volatility in MXN, but more importantly, this opens the door for more intervention in the short term, putting a floor on MXN weakness in our view. Finally, the large increase in monthly remittances that we expect post a 10% move will likely help stabilize MXN, especially given the narrowing of the trade balance.

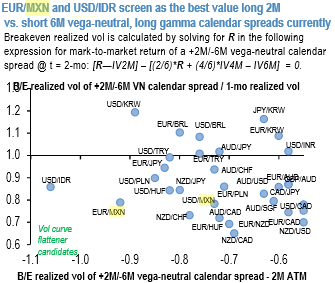

Subsidized gamma longs via +2M/-6M vega-neutral calendar spread that fade this curve steepness are good value in MXN and IDR.

We had flagged MXN and TRY as the two currencies where curve-based gamma longs offered good value; both delivered solid returns on the week judging from the above charts show that EURMXN still remains a favored gamma buy in vega-neutral calendar format.

MXN, like other petro-currencies, has decoupled from the surge in oil prices and responded more forcefully to idiosyncratic domestic (elections) and international (NAFTA) political factors, and is potentially susceptible to sharp mean-reversion stronger, especially after official FX intervention appears to have been successful in stemming runaway peso weakness.

Additionally, while it matters much less for short-tenor options, it does not hurt that EURMXN implied vols look historically underpriced in relation to the carry in forward points: the above chart shows that the carry/vol ratio of EURMXN straddles – defined as at expiry payout of the straddle assuming unchanged spot/current option premium – has spiked to levels last seen in the go-go pre-Lehman years, hence there is even a case for playing for near-term reversal of recent peso weakness via options. Courtesy: JPM

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different